This article originally appeared in the American Journal of Roentgenology, written by Dr. Howard Forman, editor of health policy for the American Roentgen Ray Society (ARRS).

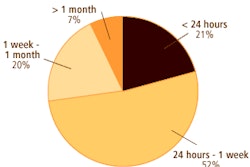

In 2004, we spent nearly $1.9 trillion on healthcare (see figure 1, below).

|

This "headline" figure is astounding for many reasons. First of all it means, with almost near certainty, that in the current year (2006) we are going to spend WELL over $2 trillion on healthcare. (I would estimate that this figure will be $2.2 trillion or more.)

The reported growth rate was 7.9%, which is really quite reasonable and has been promoted by the administration and the press as a favorable sign that healthcare "inflation" is coming down. Healthcare expenditure growth (which really is different than healthcare inflation) dropped from a reported 8.2% in 2003 and 8.8% in 2002. However, what has not been reported is that there were substantial revisions to the earlier data. In fact, accounting for revisions, the 2004 spending was actually more than 13% higher than for 2003. 2004 was also the first year that private sector spending (nongovernmental) exceeded $1 trillion.

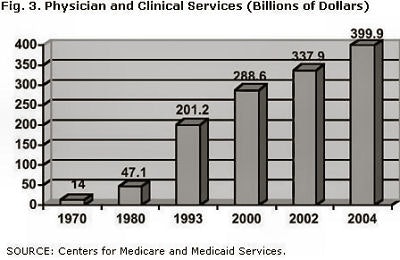

Healthcare is now 16% of GDP -- the highest it's ever been -- and still rising. After reviewing the revisions, we see that this figure has risen, almost steadily, from 7.2% in 1970, to 9.1% in 1980, and to 16% in 2004 (see figure 2, below). It is the highest figure for any country in the world.

|

As many of you will recall, I believe that there is no absolute figure that is too high; however, it is important to note that when spending on healthcare consumes an ever-rising percent of our national output, other potential spending suffers. Ideally, we would find that this increased spending afforded us a higher quality of healthcare and living; the evidence is less than supportive in this regard, as other countries with substantially lower healthcare spending appear to have better health outcomes and access to healthcare.

There have been relatively few shifts in healthcare spending growth in the most recent report. Much touted is the slowdown in prescription drug spending. For more than a decade, the growth in prescription drug spending has been more than 10%, with a 15.9% rate of growth in 2000, and a 14.3% rate of growth in 2002. In the 2004 calendar year, the rate of growth dropped to 8.2%. Note, however, that this is still greater than the rate of overall healthcare expenditure growth, and this means that prescription drug spending is still consuming more of the healthcare pie.

Home healthcare has been growing at double-digit rates and grew by 13.3% in 2004. While it is currently a small component of overall spending ($43.2 billion, compared to prescription drug spending at $188.5 billion), the rate of growth bears watching, particularly when one considers the demographic shift that is occurring in the U.S. as the baby boomers age.

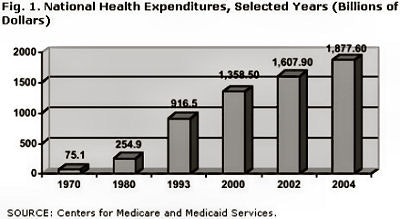

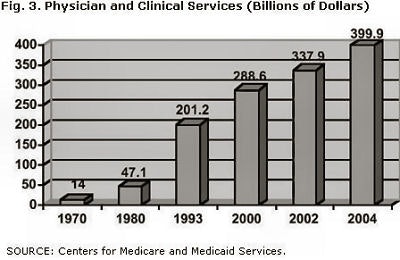

Physician spending (and by this, we are including the technical component of our practices as well as the cost of running all physician clinical services) in this country has now reached $400 billion (see figure 3, below). The rate of increase in this component is now 9%, up from 8.2% and 8.6% in 2002 and 2003, respectively. This, too, bears watching, and it is a target for cost-cutting budgeteers in Congress.

|

The main reason for the upward revision to the current news release was a sharp change in the way that investment has been measured. The revision now allows for the inclusion of medical sector capital equipment (which obviously is very relevant to our practices and includes radiology equipment). This revision added $44.3 billion to the 2003 estimate and, almost singularly, shifted the total healthcare spending in the U.S. upward by the largest amount in the history of this data tracking.

When one looks at the overall data, one cannot help but be concerned that imaging costs play a major role in overall spending. Estimates from private sector economists put the spending on imaging in this country somewhere in the ballpark of $200 billion to $250 billion, which is comparable to prescription drug spending.

It is exceedingly difficult to actually break out the figure separately, in the same way as other components, primarily because imaging occurs in so many different settings. It is also naive to imagine that "imaging" is attributable only to radiologists. As most of us are well aware, imaging occurs in the offices of many nonradiologists, and even traditional imaging practices may be staffed by nonradiologists. Still, both private sector and governmental bodies are eyeing imaging as a source for future savings.

While the current decline in healthcare expenditure growth is welcome, we shouldn't feel comfortable. We only need to look a few years in the future to the retirement of the baby boomers and their ever-increasing health needs as a predictor of dramatic increases in healthcare demand. The rapid shifts in employer-sponsored retiree benefits and the greater attention paid to the Medicare program in the last decade all bear watching closely. In two coming policy briefs, guest editors will look at the advantages and disadvantages of a very different model of healthcare: that of Canada. I hope you will read this two-part series.

As always, I welcome your feedback about other healthcare policy issues you'd like us to address.

By Dr. Howard Forman

AuntMinnie.com contributing writer

April 26, 2006

Dr. Forman is editor of health policy for the American Roentgen Ray Society (ARRS). This article originally appeared in the American Journal of Roentgenology (March 2006, Vol. 187:3). Reprinted by permission of the ARRS.

Related Reading

M.B.A. education for physicians: cross-training options, January 25, 2006

Dual eligibles: Rarely mentioned, critically important, December 22, 2005

Government response to escalating imaging costs, December 12, 2005

BEIR VII and separating fact from fear, November 18, 2005

Medicaid cuts and radiology's quandary, September 13, 2005

Copyright © 2006 American Roentgen Ray Society