Digital radiography (DR) has been a revolution-in-the-making far longer than its proponents could have wished or expected. Although DR has been touted as a virtual panacea for all that ails radiography departments -- from lost exams to the high cost of x-ray film to the shortage of radiologists and technologists -- it has so far failed to take the sluggish x-ray equipment market by storm.

Of course, this does not negate DR's promise of greater efficiency and cost-effectiveness. Rather, the painfully slow evolution of the DR market reflects the prevailing dynamics among both end users and manufacturers, neither of which are quite ready to make the all-out transition to DR.

An in-depth analysis of these dynamics shows that it is unlikely that general radiography will undergo a wholesale paradigm change within the next few years. Despite the hopes of DR vendors and enthusiasts alike, considerable barriers to the widespread adoption of DR will probably persist for some time to come. For the time being, many (if not most) end users will maintain that CR and film-based radiography are still technically, clinically, and economically the best alternatives.

A slow start

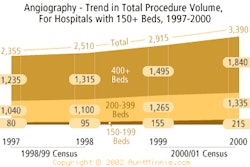

In 2000, real revenues generated by worldwide market sales of DR equipment totaled approximately $95.6 million. This was 44% higher than 1999 revenues, and more than double the revenues generated in 1998, which was the first year that DR systems were commercially sold in significant numbers.

However, $95.6 million is a far cry from the billion-dollar market that many vendors hope for. Looking toward the future, a more realistic assessment of the market yields much more conservative figures. In 2007, combined U.S. and European digital radiography revenues may reach $360 million, but almost certainly not $1 billion.

The bulk of DR installations during the next few years are likely to go to early adopters, namely major academic hospitals and regional medical centers with a well-developed PACS infrastructure. This is a select group of no more than 200 or 300 facilities. Especially in the U.S., these innovators are expected to carry the early DR market. Even after DR prices begin to fall to more affordable levels, demand will continue to be constrained by the replacement cycles that virtually define the general radiography market.

Another characteristic of DR revenues warrants further discussion: A large proportion of DR units installed from 1998 through 2000 (and well into 2001) were for promotional purposes and/or clinical testing in connection with FDA and CE clearance requirements. Almost without exception, DR vendors heavily subsidized these placements, especially the installation of products that were not yet FDA-approved.

In this market, vendors are extremely eager to introduce end users to their newest offerings, even if this means absorbing expenses by categorizing them as marketing, product development, or promotional costs. It is clear that these installations represent little or anything in the way of real revenues to vendors, and therefore calculations that take them into account (mistakenly assuming that they represent full-price revenues) are likely to be overly optimistic.

End-user confusion

So far, global DR market penetration has been marginal at best, considering the vast size of the combined U.S. and European conventional radiography installed base, which is estimated at over 200,000 units. Up to this point, DR installations have been largely restricted to a select group of major hospitals with adequate capital equipment budgets and well-developed PACS infrastructures.

One of the reasons behind the slow pace of DR adoption is end-user confusion stemming from the lack of an industry-wide standard for detector technology. There are essentially four different detector technologies offered by the various vendors: amorphous silicon, amorphous selenium, charge-coupled devices (CCD), and complementary metal-oxide semiconductor (CMOS) chips.

From a clinical standpoint, the question of which type of detector is the absolute winner has not been settled. More important, the end-user market hasn’t settled on a favorite either. Installations thus far have been fairly evenly distributed among the various detector solutions. Each type of detector is represented in the installed base, though the installed base is admittedly small, in both absolute and relative terms.

High prices constitute another roadblock to faster growth of the DR market. Prices for a complete DR system range well above $300,000, although there are retrofit systems available for less. However, retrofit installations have been in the minority so far. The high price of DR systems makes them look less attractive from an economic perspective when compared to high-end conventional x-ray systems, and even CR systems.

CR, in particular, poses the greatest challenge to the DR market because of its lower price-performance profile. Like DR, CR is able to deliver a digital image, and even if CR’s productivity and image quality may not equal that of DR, end users evidently believe that these factors are offset by CR’s lower price. Most large and medium-sized hospitals implementing PACS networks choose CR over DR, primarily for cost reasons. The bulk of prospective DR buyers will only lose interest in CR, however, once DR prices come down to a more competitive level.

A need for PACS

A closely related factor that also inhibits the DR market is the limited penetration of PACS. While PACS is not an absolute prerequisite for DR, the widely publicized economic benefits of DR, including elimination of film-related costs and dramatically increased patient throughput, are virtually impossible without a well-developed PACS infrastructure.

The global cost for a medium-to-large hospital's complete transition to enterprise-wide PACS has been estimated at between $2 million and $6 million. Because of this, most hospitals prefer to build up to enterprise-wide PACS step by step. In the interim, they are still printing out digitally acquired x-ray images on laser film for diagnosis and referral.

Thus CR offers a better fit with the hybrid analog-digital structure at many facilities. The necessity of printing hard copies eliminates the possibility of saving money on film, especially since laser film is even more expensive than regular x-ray film. So a hospital that has only achieved partial PACS integration is likely to choose CR, because it's less expensive. The difference in price between DR and CR can be spent on laser film and printers.

The technical challenges inherent in designing and manufacturing digital image acquisition systems also continue to plague the DR market. Many manufacturers offer DR systems based on full-area unitary flat panels, as opposed to CCDs or other types of tiled or optically linked semiconductor chips.

Large-area single-element panels are notoriously difficult to manufacture economically and in volume. Although a few dedicated facilities that produce detector plates are fully operational, most of these facilities have not been running at full production capacity until very recently. Even with these facilities finally online, capacity-related problems remain.

Over 15 vendors are actively marketing DR products to end users, but only a handful of manufacturers supply digital detector plates to these vendors. This situation aggravates the shortage of detector panels, making it difficult for OEMs to fill their back orders for DR units. Even with global annual demand for DR systems of a few hundred units, producers are not yet able to quickly meet even this low level of demand.

Therefore, a number of engineering issues must be resolved in order to improve the production of detector plates. Manufacturing needs to be faster, more efficient, and less costly. The manufacturing process for amorphous single-element panels, especially amorphous silicon with a cesium iodide scintillator, currently requires a lengthy and complex production sequence.

Moreover, the development and implementation of optimized, quality-controlled mass-production techniques are still months away. For this reason, adequate production capacity has not been assured. The capacity to make flat-panel detectors simply has not matured yet. So delayed delivery of DR subsystems will be an important structural barrier preventing faster growth in the DR market, at least in the short term. This set of problems also contributes to the high price of DR.

Gradual adoption

Despite high prices, the lack of an industry-wide technology gold standard, limited PACS infrastructures, and the lag in achieving efficient flat-panel production, there are several market dynamics that are likely to enhance the DR market in the mid-to-long-term. The most important of these factors is the drive in general radiography to contain costs.

As the biggest cost contributor in radiology departments, general radiography generates the largest number of exams, requires the largest number of personnel, and occupies the greatest square footage. General radiography also requires considerable personnel, space, and logistical resources for film archival, retrieval, and transport.

When used in conjunction with PACS, DR offers radiology departments a means to reduce or eliminate many of these fixed and scalable expenses. For example, digital x-ray systems can obviate cassette handling and film processing. Film is completely removed from the equation, so delays and inefficiencies inherent in film development, storage, retrieval, and distribution are eliminated.

This translates directly into increased patient throughput and lower operating costs. The cost consciousness of healthcare providers, coupled with digital radiography's promised ability to provide greater cost-effectiveness, is therefore expected to be a major driver for this market.

Although the most formidable restraint on the digital radiography market during the next two to five years will be high prices, costs are expected to decrease significantly in later years. Economies of scale and more efficient manufacturing processes for flat-panel production can be expected in the mid-term. These developments are in turn expected to contribute to more affordable pricing for DR systems, making it more likely that medium and small hospitals and outpatient facilities will choose to purchase DR technology.

Once DR prices fall to more competitive levels, and as end users begin to see that ostensibly small differences in productivity between DR and CR may quickly add up, it is also likely that end users will begin to favor DR over CR.

It now appears quite clear that both end users and vendors have a long road to travel before DR makes its way into all (or even most) radiology departments. Currently, DR sales represent only a fraction of the total yearly replacement market for x-ray systems. It will require several years of technological maturation and PACS network development before the DR market can begin to enjoy significantly increased unit shipments and market revenues.

Even once this happens, the DR market will remain largely constrained by the replacement cycles of x-ray equipment. The x-ray installed base is likely to be digitized gradually, growing incrementally each year as facilities replace worn-out conventional and CR x-ray equipment with DR. Thus, the transition to DR seems more like an evolution than a revolution.

By Antonio GarcíaAuntMinnie.com contributing writer

March 19, 2002

Antonio García is a medical imaging industry analyst at Frost & Sullivan, a San Jose, CA-based market consulting and training firm. The data and analysis in this article are included in a recently published Frost & Sullivan report on the DR market: "The U.S. and European DR Market (A074-50)." For more information, call Charlie Turnbow at 210-247-2472 or e-mail him at [email protected].

Related Reading

Report: Multislice scanners drive CT growth, February 21, 2002

PACS: The best thing to happen to RIS?, February, 18, 2002

Digital x-ray market to hit $356 million by 2007, February 5, 2002

Rush to open: The new dynamic in high-field MRI, November 23, 2001

Copyright © 2002 AuntMinnie.com