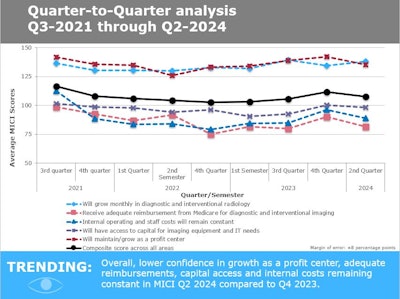

Radiology administrators are confident that diagnostic and interventional radiology will continue to grow as a profit center, according to The MarkeTech Group's Medical Imaging Confidence Index (MICI) new report for the second quarter of 2024.

They're also confident that diagnostic and interventional radiology volumes will grow monthly. But they're less sure that their departments will receive adequate Medicare reimbursement for exams and that internal operating expenses and staff costs will remain constant compared to fourth-quarter MICI results.

The MarkeTech Group generates the MICI report from survey responses by radiology administrators and business managers who are members of its imagePRO panel. The document is made up of responses to questions about five trends radiology administrators face in the coming year.

This second-quarter report included feedback from 150 imaging directors and managers across the following U.S. geographic areas: 19% in the West North Central region; 10% in the East North Central region; 13% in the Mid-Atlantic region; 11% in the South Atlantic region; 13% in the East South Central region; 15% in the West South Central region; 12% in the Pacific region; and 6% in the Mountain region.

In terms of hospital/facility size, 46% of survey respondents reported 100 beds or less, 37% reported 100 to 349 beds, and 17% reported 350 beds or more.

Respondents ranked their confidence on five topics, and The MarkeTech Group calculated a single composite score. Scores ranged from 0 to 200 and can be interpreted in this way:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

For the second quarter of 2024, the report found the following:

| MICI Q2 2024 confidence scores by topic | ||||

|---|---|---|---|---|

| Topic | Mean score Q4 2023 | Interpretation | Mean score Q2 2024 | Interpretation |

| Will maintain/grow as a profit center | 142 | Very high confidence | 135* | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 135 | Very high confidence | 138* | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 100 | Neutral | 98* | Neutral |

| Internal operating and staff costs will remain constant | 96 | Neutral | 89* | Low confidence |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 90 | Neutral | 82* | Low confidence |

| Composite score across all areas | 112 | High confidence | 107* | Neutral |

| *Statistically significant change | ||||

Respondents from all hospital bed sizes registered very high confidence that their departments will grow as a profit center and grow monthly, and all regions -- except East South Central -- had high confidence in growth in diagnostic/interventional radiology, the group found. The responses also showed that all regions except the South Atlantic and West North Central have low or very low confidence in receiving adequate Medicare reimbursement.

Graphic courtesy of The MarkeTech Group.

Graphic courtesy of The MarkeTech Group.

The survey also featured a free-response section under which participants commented on the five topics. Regarding study volume increases, respondents said that "We have several capital venues that are already coming down the pipeline"; "Imaging will continue to grow on all fronts due to an influx of patients and long delays to get into primary care physician offices for appointments"; and "More patients are getting older and needing more studies performed."

Respondents expressed uncertainty about Medicare reimbursement, stating that "Reimbursement continues to be a large concern as more individuals use insurance plans that do not pay well for medical care"; "the pay ration versus exam unit cost is [inadequate]"; and "Funding for imaging is limited as we are included in all the hospital's capital needs."

Finally, regarding operating and staff costs, survey participants noted that "Staffing remains a challenge, so retention and recruitment costs continue to increase"; and "Staffing shortages are still an issue and the salary expectations are still increasing."

The Medical Imaging Confidence Index (MICI) is produced by market research firm The MarkeTech Group using data from its imagePRO panel of radiology administrators and business managers.