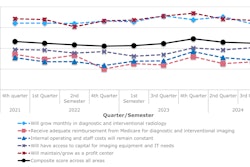

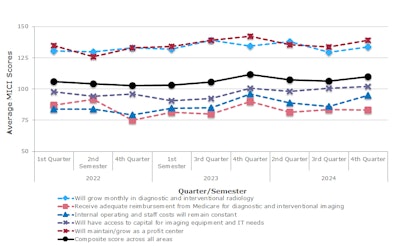

Radiology administrators have very high confidence that imaging will grow as a profit center, according to The MarkeTech Group's Medical Imaging Confidence Index (MICI) report for the fourth quarter of 2024.

They also have very high confidence that diagnostic and interventional radiology volumes will grow monthly, with a ranking higher than last quarter's results. But as in Q3, they're not optimistic that their departments will receive adequate Medicare reimbursement for exams. Administrators ranked as "neutral" their confidence that internal operating expenses and staff costs will remain constant and that they will have access to capital for imaging equipment and IT needs.

The MarkeTech Group produces the MICI report using survey response information contributed by radiology administrators and business managers who are members of its imagePRO panel. The document is made up of responses to questions about trends radiology administrators face in the coming year.

This fourth-quarter report included feedback from 135 imaging directors and managers across the following U.S. geographic areas: 19% in the West North Central region; 10% in the East North Central region; 13% in the Mid-Atlantic region; 12% in the South Atlantic region; 14% in the East South Central region; 15% in the West South Central region; 12% in the Pacific region; and 5% in the Mountain region.

As for hospital/facility size, 46% of survey respondents reported 100 beds or less, 37% reported 100 to 349 beds, and 17% reported 350 beds or more.

Respondents ranked their confidence on five topics, and The MarkeTech Group calculated a single composite score. Scores ranged from 0 to 200 and can be interpreted in this way:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

For the fourth quarter of 2024, the report found the following:

| MICI Q4 2024 confidence scores by topic | ||||

|---|---|---|---|---|

| Topic | Mean score Q3 2024 | Interpretation | Mean score Q4 2024 | Interpretation |

| Will maintain/grow as a profit center | 134 | Very high confidence | 139 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 129 | High confidence | 134 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 101 | Neutral | 102 | Neutral |

| Internal operating and staff costs will remain constant | 86 | Low confidence | 95 | Neutral |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 84 | Low confidence | 83 | Low confidence |

| Composite score across all areas | 106 | Neutral | 110 | Neutral |

Respondents from all hospital bed sizes reported high to very high confidence that their departments will grow as a profit center and grow monthly, and survey participants from all U.S. regions expressed high confidence in growth in diagnostic/interventional radiology, the group found. But the survey also reported that all regions except the South Atlantic had very low or low confidence in receiving adequate Medicare reimbursement. In the Mountain region, administrators also had very low confidence that their departments would have access to capital for equipment and IT.

The survey always includes a free-response section under which participants may comment on the five topics. Free responses included in this report mainly addressed topics for which respondents' confidence was low.

Regarding study volume increases, respondents said:

- "Volumes are projected to grow, but contractual agreements have increased, causing a loss of revenue."

- "More chronic diseases will require more intensive care."

- "Patients are getting older and sicker … imaging continues to show growth in our area."

- "Our volumes are steadily increasing with the addition of new providers adding to the volume mix. We are constantly backlogged in anesthesia imaging requests … We barely have enough staff to cover operational needs and continue to use travelers."

Regarding healthcare policy and Medicare reimbursement, respondents stated:

- "Appropriate reimbursement continues to be a major issue, especially in advanced areas such as CT, MR, and interventional radiology. There are a lot of great services we could provide but they are hindered by preauthorization denials.

- "Reimbursement might be going down in the near future."

Finally, regarding internal operations and staffing, survey participants noted:

- "We continue to struggle with interventional radiology, especially on the professional billing side. This has made it very difficult to recruit for radiologists … [and] lack of interventional radiologists is a limiting factor in our ability to grow. Additionally, cardiologists and vascular physicians are now performing our exams so we are spreading the same volume around versus growing it.

- "Funding capital equipment has been a challenge. Department funding allocations have dropped, which [makes it] challenging to keep up on volumes."

- "Capital approval is based on break/fix. Staff shortages due to pipeline issues and popularity of agency/travel assignments are raising tech salaries in the region."

- "Dollars available to replace or add capital equipment are lacking. Expenses for supplies and salaries continue to rise … We continue to struggle with receiving adequate and/or timely payment from some of the payers."

The Medical Imaging Confidence Index (MICI) is produced by market research firm The MarkeTech Group using data from its imagePRO panel of radiology administrators and business managers.