The growth rate for CT procedure volume has slowed markedly from the double-digit pace of a decade ago, but use of the modality is still growing, and CT users are generally optimistic, according to a new market research report from IMV Medical Information Division.

IMV's 2012 CT Market Outlook Report found that those who are managing the operation of CT service in the U.S. are generally optimistic about its short-term financial prospects. The report also documents the rapid shift of CT services from within hospitals to outpatient facilities controlled by either hospitals or integrated delivery networks.

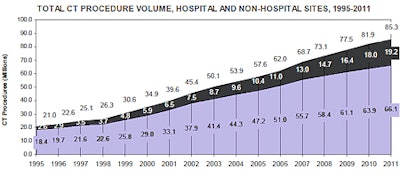

The report, the 11th in a series on CT from IMV since 1993, estimates that 85.3 million CT procedures were performed by U.S. hospital and nonhospital services in 2011. Overall utilization rose 4% compared to the previous year. The report's findings were based on responses from 405 radiology and CT administrators to a Web-based questionnaire and selected phone surveys. Responses were projected to a universe of 8,465 hospital and nonhospital locations to generate national statistics.

The findings reflect a general deceleration of the growth rate in CT procedure volume since the peak a decade ago, when CT growth rates hit 13% or higher, noted Lorna Young, senior director of market research at IMV. The growth rate slowed incrementally to about 8% between 2005 and 2007 and to about 6% between 2008 and 2010 before reaching its current level, she said.

The report attributed last year's 4% growth to a 3.5% increase in the number of CT sites from the previous year.

The average volume of CT procedures per site for all CT sites was essentially flat between 2010 and 2011, at an average annual growth rate of 0.6%, from 10,010 exams per site in 2010 to 10,075 in 2011. The average number of CT procedures at imaging centers owned by hospitals or integrated delivery networks (IDNs) grew 36%, from 7,270 to 9,905 procedures per site, whereas growth rates at other types of sites ranged from a negative 1% (for 200- to 399-bed hospitals) to a positive 9% (for hospitals with 400 or more beds).

|

| Purple = hospitals; dark grey = nonhospitals. |

The spike in IDN-related growth stems from strategic moves to shift CT out of hospitals to hospital-owned outpatient sites that receive relatively higher reimbursement rates than freestanding imaging centers, and to place those units conveniently near physician offices to promote practitioner loyalty, Young said.

The CT growth rates for individual facilities may be only slightly positive, but the increases are still large enough to offset payment rate reductions in 2011, she said. CT providers were affected by Medicare's decision to deepen the discounts for CT of contiguous anatomy imaged in a single session. Many private payors adopted the same policy last year.

Still, more than half of respondents (58%) estimated that their procedure volumes will grow this year, though 44% felt reimbursement levels would decrease. Regarding the resulting impact on CT revenues, 20% felt revenues would decrease, 45% felt revenues would be comparable to 2011 levels, and 30% felt their CT revenues would increase. The remaining 5% were undecided.

By a small margin, radiation safety topped the list of priorities that respondents said would affect their department's missions in the next year. The desire to satisfy referring physician needs, improve workflow and productivity, and manage staffing levels to meet patient volume and scheduling needs were listed as high priorities.

"People are looking for good value," Young said.

This desire is reflected in purchaser preference favoring either scanners with 64 or more slices or more economical 16-slice CT technology. About two of every three respondents who plan to buy a new scanner said they probably will buy a system with at least 64-slice capability, but interest in 16-slice scanners remains strong.

Sixty-four-slice CT was originally marketed for cardiovascular applications, Young noted. But users have come to appreciate the productivity implications of its high acquisition speeds. The scanners have also earned a reputation for high image quality. Most of the industry's most sophisticated features aimed at radiation reduction are available on premium 64-slice platforms, she said.

After nearly a decade of use, 16-slice CT still serves as an economical option deemed adequate for many routine clinical applications, Young said.

According to the report, pelvic and abdominal procedures constituted 24% of all CT procedures in 2011. Brain studies accounted for 20%, followed by chest (16%), head and neck (10%), CT angiography (10%), and spine (7%).

Studies involving CT guidance or imaging of the lower or upper extremities each accounted for between 2% and 4% of the total. The remaining 3% included cardiac imaging, whole-body screenings, and virtual colonoscopy (also known as CT colonography or CTC).

According to previous IMV CT reports, pediatric CT has represented 9% to 11% of the modality's total annual volume since 2006. The current survey established that nine of 10 CT services will accept infants, children, and adolescents for imaging. However, only two of every 100 services that examine young patients generate more than 25% of their total CT volume from pediatric referrals.

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.