Some 65% to 70% of all imaging exams rely on radiography, the last modality to go digital. Once x-ray makes the leap from analog to digital, however, it will reap the benefits of sending and storing images electronically like other modalities. The trends driving PACS are the same ones pushing general radiography toward digitization.

Digital radiography (DR) sales have been disappointing since the first systems hit the market, but radiology staffing shortages are driving faster adoption of PACS as well as DR. Hospitals are adopting strategies "designed explicitly to substitute technology for missing workers and extend the productivity of those who remain," according to Forrester Research’s Top 10 Healthcare Predictions for 2003.

Meanwhile, DR systems are coming on the market with larger image receptors, higher resolution, and increased functionality. Increased competition and innovation should mean lower prices for imaging facilities. Radiology sites are counting on both CR and DR to help cope with radiologic technologist shortages -- DR should result in workflow improvements that will help radiology departments function with smaller staffs.

DR is in a growth stage, but the modality hasn’t really taken off because of price, according to Deborah Imling, radiography marketing manager for Philips Medical Systems in Andover, MA.

"I think there has been sticker shock," she said. "When people who want to replace an analog room go to DR and see the pricing, they’re a bit in shock because they haven’t budgeted for it."

Although hospitals contemplating the switch to digital would like to see off-the-shelf cost models, vendors say each facility is so unique that strategies must be designed to fit them individually. But even with DR’s higher cost, industry experts agree that it could be the most economical choice under certain conditions.

Evolving definitions

There are some differences in how industry observers define various digital radiography modes. For the purposes of this article, CR will be used to refer to storage phosphor cassette-based systems, and DR to refer to technologies using non-cassette image receptors, such as amorphous selenium, amorphous silicon, or charge-coupled devices (CCDs).

In CR, a storage phosphor imaging plate replaces the conventional film-screen cassette. The gantry, x-ray tube, and exposure control systems are usually the same as those used in analog x-ray. The technologist positions the patient and places the phosphor imaging plate in the bucky. An exposure is made and the technologist places the plate into a reading device, where it is scanned by a helium-neon laser.

The electrons are irradiated by a secondary excitation (the laser). When the electrons then return to a lower energy level, light is emitted and captured by a photomultiplier tube. The tube converts the data into an analog electrical signal, which is subsequently digitized. CR thus creates a digital image that can then be processed, stored, and transmitted in the same way as DR images.

DR substitutes an electronic detector made of amorphous silicon, amorphous selenium, or a CCD for the film-screen cassette. This detector captures the x-ray image and sends it to a display screen.

Although there are some newer exceptions that blur the technologies, the easiest way to distinguish the two approaches is to think of CR as cassette-based, and DR as cassetteless. DR is somewhat faster in producing a readable image. CR improves the imaging department’s workflow less dramatically, because technologists must take cassettes to a plate reader, while DR images can be sent directly from tableside into a PACS. CR is sometimes more versatile, however, as DR detectors that are table-mounted may not be able to perform certain projections.

Digital technologies

ECRI, a nonprofit health services research agency based in Plymouth Meeting, PA, that investigates medical devices and systems, in 2001 took a look at DR systems from three vendors (Hologic of Bedford, MA; GE Medical Systems, of Waukesha, WI; and Philips), and concluded that all produced better-quality diagnostic images, and had higher patient throughput, than either film-screen or CR systems.

However, DR systems are considerably more expensive than CR systems. And until very recently, DR detectors had to be installed in a fixed gantry, so most portable studies still have to be performed with CR or film-screen units.

Flat-panel vendors are working on products that could erode CR’s dominance in the portable arena. Canon Medical Systems of Irvine, CA, has developed the CXDI-31, a flat-panel detector with a 9 x 11-inch (23 x 30-cm) field of view that has Food and Drug Administration clearance, and the CXDI-50G, a 14 x 17-inch (36 x 40-cm) system that was cleared by the FDA in June.

These detectors can be incorporated into portable x-ray systems, such as the Shuttle system, introduced at the 2003 European Congress of Radiology by Instrumentarium Imaging of Milwaukee. Although these systems fulfill the role of flat-panel mobile radiography, they are fragile, and there still has to be a means of transmitting the data from the portable unit to the PACS.

Varian Medical Systems of Palo Alto, CA, also manufactures flat-panel detectors that could be considered portable. These will be sold through OEMs, which will be responsible for FDA clearances.

Other technologies

A number of vendors are offering desktop CR readers, which can be used in areas outside the radiology department, such as remote clinics or low-volume offices. These low-cost systems -- priced at $65,000-$70,000 -- are extending CR’s reach into areas where the use of digital x-ray was cost-prohibitive.

A wildcard in the pack is the recently introduced Lodox Statscan system, from Lodox Systems North America of South Lyon, MI. The Statscan is a full-body DR system based on linear slot-scanning technology, with a C-arm that moves over and around the patient on the table.

Lodox’s parent company is based in South Africa, where the technology was developed to scan diamond mineworkers to ensure that no gems were concealed or swallowed by workers at the end of their shifts. Although the technology is intriguing, it still needs to prove itself: Lodox has just begun marketing the system in the U.S., with the first installation being completed in June at the University of Maryland Medical Center in Baltimore.

A full list of CR and DR vendors and models can be found in the AuntMinnie Buyer’s Guide.

The cost-justification challenge

Part of the challenge of pitching digital x-ray for its quality to radiology administrators is that most radiologists and referring physicians are satisfied with the quality of film images. Thus, for most customers, the decision comes down to cost. DR systems must be able to match the image quality of film, and then offer the digital advantages at a competitive cost.

In addition, some experts warn that a level of redundancy can be lost when radiology operations embrace DR. In the nondigital world of film, the probability that all film processors in the department would be down at the same time was remote. When a single DR system replaces all film processors, as is common with DR sites, this safety net vanishes.

"Radiology departments need to have a redundant mechanism to view and process radiographic exams, such as adding a CR device or even a second DR," said Henri "Rik" Primo, director of medical solutions in the IS/PACS CN department at Siemens Medical Solutions of Malvern, PA.

Multiple DR systems should be connected to multiple workstations that can store images for a day or so, Primo said. Then, if the radiology PACS network goes down, operations can continue in a "graceful degradation" of functionality, similar to the CT/MR model. A radiologist can still view exams on the CT or MR operator console if the network is down.

The economics

Most flat-panel DR systems are priced at $400,000-$650,000. Buying a detector separately and retrofitting it to an existing x-ray room costs less, but most facilities buy full new rooms. The number of detectors in a room raises the cost; a chest-only room, for example, is more affordable than a room that incorporates a table and a chest stand. Non-flat-panel DR systems range in price from $100,000 to $400,000.

|

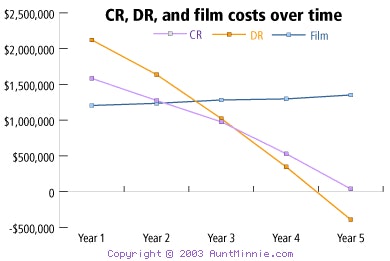

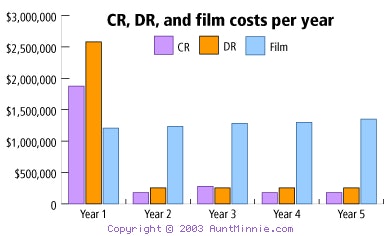

Chart data courtesy of Integration Resources.

CR, on the other hand, is far less expensive than DR. A full CR system can run from around $70,000 to $300,000, if x-ray equipment is included. CR is cheaper because existing radiography rooms can be retrofitted by simply replacing the film-screen cassette with a CR cassette.

The cassette reader, which can service two rooms, will run from $125,000 for a single-cassette reader to $225,000 for a multiple-cassette reader, according to Michael Cannavo of Image Management Consultants, a Winter Park, FL, PACS consulting firm. As mentioned earlier, tabletop CR units can bring the price point for entry-level CR even lower.

An ongoing cost with CR is plate wear -- CR plates wear out, and cost from $1,000 to $1,500 per plate to replace, depending on size. But DR is not without risks related to wear and handling -- DR detectors can also be ruined by handling, and can cost more than $100,000 if they need to be replaced, according to John Strauss, director of marketing at Fujifilm Medical Systems USA in Stamford, CT.

Technologist productivity

After the initial cost is factored in, facilities discover that the most important factor affecting the economic advantages of CR versus DR is technologist productivity. The higher cost of DR may be offset by the much higher productivity of technologists who do not have to handle and process film-screen or CR cassettes. DR thus may save labor costs as hospitals eliminate tech positions, and DR could boost revenue as the radiology department performs more exams and reduces the number of radiography rooms.

|

Chart data courtesy of Integration Resources.

Imling of Philips said she believes DR pays off better than CR after five years, because CR has higher overhead connected with its day-to-day operation, such as imaging plates, readers, and lower technologist productivity. Radiologists typically increase their productivity as well, because reading digital images does not require film handling.

A recent study by Katherine Andriole, Ph.D. at the University of California, San Francisco and published in the Journal of Digital Imaging compared results of a film-screen (analog) dedicated chest unit versus a CR reader and a DR dedicated chest unit. It showed a higher patient throughput for the digital systems, with a 12% increase in patient throughput for CR over film-screen, and a 30% increase in patient throughput for DR over film-screen.

According to Andriole, both CR and DR can improve workflow and productivity over analog film-screen in a PACS environment, but the cost justification for DR over CR is predominantly related to high patient volume and continuous use patterns. A cost comparison of the technologies shows that the high cost of DR may not be justifiable unless a facility has a steady flow of high patient volume to run the device at or near 100% productivity, she said.

That opinion is echoed by other PACS and digital x-ray experts. "If you have high throughput you can afford to install DR," said Gary Reed, CEO of consulting firm Integration Resources in Lebanon, NJ. "If you have low throughput you’ll start out with CR. CR still has a lot of potential left and the prices are coming down, and reconstruction times are coming down to less than a minute, as opposed to a second or two for DR."

A dedicated chest DR unit will show greater throughput than a table-based detector, as patients can be moved in and out of the room more quickly. To justify their purchasing decisions, some radiology administrators have argued that one DR room can do the work of several film-screen or x-ray rooms with CR.

PACS still needed

Without PACS, however, DR or CR will result in little savings, according to Jason Launders, a medical physicist at ECRI. Without PACS, digital images must be printed on laser film, which costs more than standard film, so most of the film and supply savings associated with DR evaporate.

Service contracts, typically 8% per year for DR systems, can also eat up any savings in film and supplies. And with many DR systems, the detector is fixed in the table. This means that the hospital must buy an additional detector for another $150,000 to perform chest films.

Although several vendors said they are working on return-on-investment (ROI) models for customers, they are universally reticent about sharing them, saying they craft unique ROIs for each specific customer. Reed said hospitals should be cautious about ROI studies provided by CR or DR vendors, as most tend to be biased in favor of their own products.

Deborah Imling from Philips said her company is working on a pro-forma ROI, but they don’t always work very well. "You could poke all kind of holes in them," Imling said. "Primarily, it has to do with why the customer wants to go digital. Is it from a productivity perspective? Is it due to wanting to improve the workflow? Are they having manpower shortages?"

"The first step when going into digital is to look at CR, which is more of an economical step," Imling said. "It really has to do with the patient load -- how many patients are they doing a day? How much are the film costs per year? Are they going to be using PACS? Are they still going to be printing? It’s very different for each hospital setting."

Kevin Hobert, general manager for digital capture systems at Eastman Kodak Health Imaging in Rochester, NY, says both technologies have a place. He said to look at CR as a transition to digital.

"CR gets you 75% of what you want for a fraction of the cost of DR," Hobert said. "Where DR gets slowed down is when you have to do the odd view -- the difficult projection. That’s where you need a combination of CR and DR."

Digital scenarios

The following scenarios describe how some imaging facilities have deployed both DR and CR technologies.

University of California, San FranciscoUCSF has two chest DR units and two more ordered, plus one DR table unit, according to Andriole, a member of the clinical PACS group of the Laboratory for Radiological Informatics in the department of radiology.

Andriole said the medical center’s nine CR units are mostly portable in the emergency department and the ICUs. She said film is used only in the operating rooms, by a few orthopedic surgeons, and by a few other medical staff.

Ingalls Memorial Hospital, Harvey, ILIngalls is a 420-bed hospital that conducts some 110,000 radiographic studies each year, counting offsite exams. The facility has two Swissray International (Elmsford, NY) DR machines, one offsite, which it acquired for about $375,000 to $400,000 each, according to Jack Branding, the hospital’s administrative director of radiology. The facility bought a PACS and a Fuji CR system as a package for about $2.3 million for all its diagnostic radiography units, along with one multiplate and two single-plate readers.

The hospital has Web-based access to its PACS for referring physicians, and the facility is filmless except for a few referring physicians, the OR, and mammography. Its RIS is actually the HIS legacy system, which functions as a RIS.

Holland Community Hospital, Holland, MIThis hospital has only 213 beds, but conducts 100,000 procedures a year in four radiography rooms. The facility has just purchased a Philips PACS, according to PACS administrator Mark Clawson, and will use a Mitra (Waterloo, ON) broker with a RIS from Per-Se Technologies of Atlanta.

The hospital has not decided on which CR to purchase, a decision that has been dependent on the PACS installation. The hospital budgeted around $1.4 million for the PACS and broker, and $400,000 for two CR units with cassettes and readers.

Clawson said he anticipates an 80% filmless operation. Representatives will go directly to referring physicians’ offices, sit down with office managers, and show them how soft-copy reading can improve workflow.

"When we were showing the system, we invited a physician, but more important was the office manager," Clawson said. "They are enthusiastic, because they hate chasing film."

By Robert BruceAuntMinnie.com contributing writer

July 31, 2003

The data used in the Integration Resources cost analysis on film, CR, and DR was collected from more than 200 hospitals across the U.S. It was taken from budget reports and confirmed by radiology administrators and chief financial officers (CFOs). Hospitals ranged in size from 50 beds to more than 1,000 beds, from university medical centers to community and large enterprise hospitals, as well as from more than 50 outpatient imaging centers.

The cost data was weighted and averaged across the U.S. Costs were similar for film, chemicals, processors, jackets, labels, and other supplies. The largest cost variable was for technologists, file-room clerks, and film-processing staff salaries.

Related Reading

DR is tolerant, but not foolproof, June 10, 2003

Flat-panel unit beats CR for digital mammography, March 7, 2003

CR and DR cross swords in RT productivity debate, May 3, 2002

Copyright © 2003 AuntMinnie.com