The Deficit Reduction Act (DRA) of 2005 took a meat cleaver to reimbursement at U.S. outpatient imaging facilities when it went into effect in 2006. DRA opponents predicted that the law would force private imaging centers to close, shift imaging to less-convenient hospital settings, and reduce access to seniors. But has that really happened?

Yes and no, according to research published in this month's Journal of the American College of Radiology. The study paints a complex picture of the DRA's effect on imaging, suggesting that while some predicted outcomes have materialized, others -- such as a widespread reduction in access to imaging -- have not.

Still, there's no guarantee that access to imaging will continue to be unaffected by the DRA in the years to come, according to Dr. David C. Levin, Dr. Vijay Rao, and Laurence Parker, PhD, of Thomas Jefferson University (JACR, January 2012, Vol. 9:1, pp. 27-32).

For example, the researchers found that nuclear medicine outpatient volume dropped by 5.7% from 2006 to 2009, despite rapid growth in PET. They concluded this could be a sign of loss of access to this modality for Medicare beneficiaries, as well as a harbinger of things to come in CT and MRI, especially if the U.S. Centers for Medicare and Medicaid Services (CMS) imposes further reimbursement cuts.

Three questions

The DRA cuts posed three questions when they went into effect, according to Levin and colleagues:

- Would private office imaging facilities be forced to close?

- Would advanced imaging examinations be shifted to less convenient hospital-based facilities?

- Would patient access to advanced imaging be jeopardized?

In their study, Levin, Rao, and Parker sought to determine whether these developments did, in fact, occur during the years after the DRA was implemented.

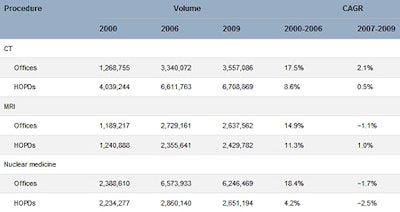

The authors studied Medicare data and outpatient CT, MRI, and nuclear medicine trends before and after the DRA. They tabulated procedure volumes performed in private offices and hospital outpatient departments separately, tracked volumes from 2000 to 2006 (before the DRA) and from 2007 to 2009 (after the DRA), and calculated compound annual growth rates for the two periods.

The group found that in all three modalities, growth in imaging volume before the DRA was far more rapid than after its implementation. Compound annual growth rates from 2007 to 2009 in offices and hospital outpatient departments were, respectively, +2.1% and +0.5% for CT, -1.1% and -1% for MRI, and -1.7% and -2.5% for nuclear medicine. Growth trends in all three modalities flattened beginning around 2005 to 2006.

Outpatient Medicare volumes of CT, MRI, and nuclear medicine in private offices and HOPDs before and after implementation of the DRA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CAGR = compound annual growth rate; HOPD = hospital outpatient department. The DRA took effect in 2007; hence, the years from 2000 to 2006 represent the pre-DRA period, and 2007 to 2009 are the first three years after the DRA was implemented. Table courtesy of the American College of Radiology. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"A dramatic slowdown in the growth of imaging began around the middle of the past decade, after years of rapid increases," Levin and colleagues wrote. "The slowdown was not due to the DRA, or at least not solely to the DRA. The proof of this is that the slowdown was felt equally in [hospital outpatient departments], which should not have been affected by the DRA. Moreover, the slowdown first became noticeable in 2005, even before the DRA was passed."

What might explain this trend? At least five factors, the team found:

- Because of extensive discussion in recent years about the need to reduce costs, physicians may be getting more cost conscious.

- Referring physicians may be responding to concerns about radiation exposure.

- Both the American College of Radiology and the American College of Cardiology have developed appropriateness criteria for imaging, and physicians may be paying more attention.

- Commercial payors have in some cases begun taking steps to limit the specialties that are eligible for reimbursement for advanced imaging, and this may have helped cut self-referral.

- Radiology benefits management (RBM) companies have instituted preauthorization programs within the commercially insured population in recent years.

"Preauthorization is now in widespread use and makes it somewhat more difficult and inconvenient for physicians to order advanced imaging studies," Levin and colleagues wrote. "Although traditional fee-for-service Medicare has not yet used preauthorization, it seems likely that radiology benefits management companies have influenced ordering physicians and induced them to think more carefully about what imaging tests they order (or whether they should order them at all)."

The authors went on to say that of all the possible reasons for the slowdown in advanced imaging growth, RBMs are probably the principal factor.

After the DRA (from 2007 to 2009), there was more rapid CT volume growth in offices than in hospital outpatient departments. Concurrently, there was some loss of nuclear medicine volume in both settings, but the loss was less in offices. Thus, in CT and nuclear medicine, offices actually fared better after the DRA than hospital outpatient departments. In MRI, hospital outpatient departments fared slightly better than offices.

"It thus seems that there has been no shift away from offices and as yet no loss of access to CT or MRI after the DRA," Levin and colleagues wrote. "However, some loss of access to nuclear medicine does seem to have occurred."

The study offers both good and bad news, Levin concluded.

"The good news is that growth in high-tech imaging has flattened dramatically," he told AuntMinnie.com. "Imaging growth had been a major concern of policymakers and payors because in the early part of the last decade, it was the most rapidly growing of all physician services -- [but] these recent trends should help allay those concerns."

"Also, it doesn't appear that the DRA led to wholesale closing of radiology private offices, although some obviously went under," he said. "The bad news is that these recent numbers could conceivably be the start of a major downturn that could mean less access for seniors. That may already be happening in nuclear medicine. Personally, I don't think a big downturn is going to happen, but the situation should be closely watched."