As breast density notification legislation continues to spread across the U.S., the new laws will begin to have greater influence not only on standards in breast imaging, but also on screening technologies, according to market research firm Frost & Sullivan.

"Given the possibility of widespread breast density reporting laws in the United States in the near future and the host of nonconventional breast imaging technologies that are already in place, standards in breast imaging could change considerably over the next 10 years," said Roberto Aranibar, Frost & Sullivan industry analyst, in a webinar given May 23.

Nineteen states have either passed breast density notification legislation or have bills in progress, and federal bill HR 3102 was introduced to the House of Representatives in October 2011, Aranibar said.

Technologies to watch

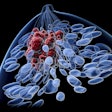

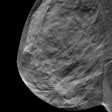

Mammography remains the gold standard for screening, but it has real limitations, especially for women with dense breast tissue, Aranibar said. Two technologies that are coming to the forefront are automated breast ultrasound (ABUS) and digital breast tomosynthesis (DBT).

Ultrasound has been shown to increase the detection of cancers by 28% when used with mammography, and it has also been shown to double the cancer detection rate in dense tissue, Aranibar said. The technology is attractive because of the large installed base of ultrasound devices and the fact that ultrasound does not expose women to radiation. There are at least three ABUS commercial units available (Siemens Healthcare, SonoCine, U-Systems); earlier this month, the U.S. Food and Drug Administration approved U-Systems' somo.v system for breast screening indications.

Connecticut was the first state to pass a breast density notification law in 2009, and demand for supplemental ultrasound skyrocketed in the state, Aranibar said.

"In Connecticut after the density notification law was passed, patient wait times for breast ultrasound increased to as long as six months," he said. "Yale-New Haven Hospital reported going from never conducting any supplemental ultrasound exams to performing more than 40 per week. And Jefferson Radiology, a private radiology practice, went from 5% to 10% of its patients wanting ultrasound breast screening to a backlog of over 500 patients."

As for digital breast tomosynthesis, when it's used with mammography it can reduce recalls by 30% to 40% compared to mammography alone, according to Aranibar. But it's also 35% to 50% more expensive than a 2D full-field digital mammography system, requires additional data storage, exposes women to more radiation, and is not reimbursed.

Three phases

Aranibar sees breast tissue density notification influencing the market in three distinct phases.

In the first, short-term phase through 2013, the demand for supplemental screening technology, particularly ultrasound, will continue to grow; facilities will try to meet demand with available equipment.

In the next phase, 2013 to 2015, patient volumes and backlogs will increase, and facilities will begin to seek more tools to streamline workflow, boosting capital investment.

"We should see ABUS start to pick up when people can justify that investment [due to demand], peaking in 2015 and then leveling off," he said.

Reimbursement for breast tomosynthesis will occur a bit later, between 2015 and 2017, Aranibar said.

"Right now there are no large-scale, multicenter clinical results that justify breast tomosynthesis to payors," he said. "But in the next five years, tomosynthesis will probably become more affordable, and the radiation dose problem will have been addressed. We'll begin to see mainstream adoption of this technology, beginning with the people who already have upgradeable systems."