When breast imaging comes to mind, mammography is the undisputed current modality of choice. Other breast imaging modalities, such as MRI and ultrasound, form a comparatively smaller part of the market. For this reason, it is mammography that has typically driven the majority of market growth in breast imaging.

In our latest report, Signify Research has predicted that growth in the mammography market will begin to slow in the coming years. We see this occurring for three key reasons:

- U.S. installed base of digital breast tomosynthesis (DBT) has started to saturate.

- Price pressure is set to increase.

- Interest and growth are expected to be driven from elsewhere.

Each of these points is explored below.

1. U.S. installed base of DBT has started to saturate.

Over the last two years, the adoption of DBT technologies has spurred rapid growth in the mammography market. This trend has been particularly pronounced in the U.S. market, which peaked in 2017 after reimbursement for DBT had been introduced a few years earlier. In the U.S., providers spend upward of $300,000 on 3D mammography solutions, compared with around $200,000 for their 2D counterparts.

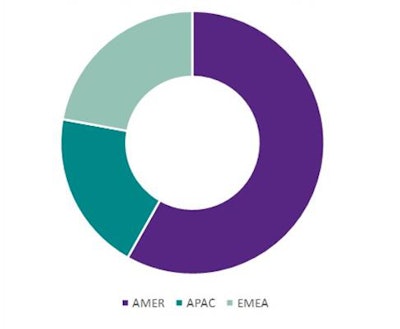

2018 Mammography market revenue

Source: Signify Research, August 2019.

Source: Signify Research, August 2019.The U.S. mammography market is unique in that it formed over 55% of the global market in 2018, as the chart above shows. Providers in the U.S. are willing to invest in higher-cost solutions, resulting in higher average selling prices that differ significantly compared with their European and Asian counterparts. It's for this reason that growth in the U.S. market has a significant impact on worldwide growth.

And as the saying goes, what goes up must eventually come down. Despite recording an increase in the installed base of systems for 2018, vendors have reported that growth in the U.S. market has begun to slow. As of June 2019, 61% of certified facilities possessed at least one DBT unit, and the market has now moved into late-stage adoption.

While the adoption of DBT is predicted to continue, albeit at a slower rate, the proportion of software upgrades, as opposed to new system installs, is expected to increase. Averaging at around $40,000 to $50,000 per software install, this gain in revenue will be significantly less compared with selling a whole new system.

In addition to this, total growth in the U.S. mammography installed base is also beginning to slow. As the chart below shows, since 2015 and the initial drive in adoption of DBT, the number of new units installed in the U.S. has been growing. However, the annual rate of growth has slowed, from 11.7% in 2015 to 8.5% in 2018, with the decline in growth rate forecast to continue over the period to 2023.

U.S. mammography installed base

Source: Signify Research, July 2019.

Source: Signify Research, July 2019.Thus, the U.S. market, which forms the majority of the breast imaging market today, is predicted to slow over the next five years. This slowdown in growth will significantly affect the global market as the U.S. has been the real engine for growth over recent years. Other large regions, like Western Europe, have seen limited growth now for several years; although high growth has been projected in regions such as Europe, the Middle East, and Africa (EMEA) as well as Asia-Pacific (APAC), the comparative gains in revenue are not predicted to be enough to maintain historical global growth rates.

2. Pricing pressure is set to increase.

The decline in global growth is also set to be exacerbated by a decline in average selling prices for mammography systems. DBT vendors have enjoyed a period of relative isolation for several years, with few competitors. This has resulted in little price pressure and prices remaining relatively high.

As an example, in the U.S. there have been largely only three vendors selling DBT solutions for several years (Hologic, GE Healthcare, and Siemens Healthineers). However, during 2017 and 2018, a number of vendors gained approval for systems to be sold in the U.S. and began to enter the market.

Vendors such as Adani Medical Systems and Planmed entered with 2D systems and can be expected to follow soon with 3D permissions, and Fujifilm Medical Systems USA gained approval for its 3D Aspire Cristalle system in 2017. These market entrants sell comparatively lower-cost solutions compared with the incumbents, with Fujifilm in particular marketing itself as a low-cost competitor to the market leader, Hologic.

This rise in competitive pressure is set to contribute in part to the overall reduction of average selling prices. To intensify this, 2018 saw Hologic respond by beginning sales of its Selenia Dimensions 3D performance system, a lower-cost DBT alternative to its 3Dimensions and Selenia Dimensions systems. The further diversification of 3D portfolios by competing vendors is expected to follow this.

Accordingly, while average selling prices have historically been maintained, this influx of lower-cost solutions is forecast to impact the market significantly over the coming years.

3. Interest and growth are expected to be driven elsewhere.

Breast imaging is beginning its transition into a multimodality practice, incorporating ultrasound and MRI technologies with increased frequency. Several large-scale studies are currently taking place evaluating the impact of the implementation of risk-based screening programs. These, which include the My Personal Breast Screening (MyPeBs) and Women Informed to Screen Depending on Measures of Risk (WISDOM) trials, are large-scale and differ from the current age-based screening model.

Imogen Fitt.

Imogen Fitt.Implementation of these programs is likely to see mammography play a principal, but less pronounced, role in screening as supplemental modalities begin to rise in popularity. This trend can be seen in its infancy in the U.S. where the continued impact of breast density campaigns is expected to lead to a corresponding rise in supplemental ultrasound screening.

Mammography's pitfalls have been well-publicized for some time, especially in dense breasts, and while DBT shows some promise in offering increased sensitivity compared with its 2D counterparts, research relating to this is much less widespread than that relating to the use of ultrasound.

Vendors are therefore considered more likely to begin to invest in supplemental modality systems once these programs begin implementation, to the detriment of the mammography market. Provider interest is therefore expected to be driven elsewhere, and the slowdown in mammography market growth is expected to herald the adoption of newer technologies in breast imaging.

As DBT has become more widely distributed, the case for machine learning has strengthened. Countries such as Sweden have now begun trials examining the large-scale implementation of programs where machine learning is being used in conjunction with DBT, and as the forecast continues, growth in this segment is expected to be strong, particularly in the North American and Western European markets.

Automated breast ultrasound systems (ABUS), previously sidelined by DBT technologies, are also now projected to gain more prominence as awareness of ultrasound imaging in dense breasts rises. Markets such as China and Japan, which also form significant parts of the mammography market, are forecast soon to increase their uptake of ABUS imaging systems. While x-ray mammography will remain a mainstay in these countries, the potential use of a modality tailored for typically dense-breasted populations offers an attractive alternative for providers.

Vendors react to decline in growth rates

To counter expected decline in the mammography market, leading vendors are now beginning to seek revenue in other segments.

Hologic, which is currently the market leader in women's imaging, has recently made extensive efforts toward expanding its portfolio, first announcing the establishment of an agreement with Philips aimed at opening up multimodality deals. Since then, Hologic has acquired a number of companies and engaged in several development and distribution agreements, including with Clarius Mobile Health, SuperSonic Imagine, Micrima, and MagView. Hologic is now planning to expand its portfolio across the entire ecosystem of breast imaging to increase its revenue streams.

GE Healthcare and Siemens Healthineers have continued to push the sales of their respective ABUS systems, and although this product segment has not performed as well as expected previously, the saturation of DBT technologies is expected to free up budgets for other considerations in the coming years.

These vendors are also now beginning to look toward using service revenue to drive growth. Many companies have begun to push service in an effort to achieve some consistency in the notoriously volatile space in anticipation of the coming deceleration.

Overall, these moves position each company well to achieve continued growth as mammography systems sales begin decelerating. The slowdown in growth in the mammography market is not a reflection of mammography falling out of favor but is more a signal that the market for its biggest revenue generator, DBT, is beginning to mature. As interest increases in other emerging technologies, growth is predicted to begin to be seen elsewhere.

Imogen Fitt is a market analyst at Signify Research, a health technology market intelligence firm based in Cranfield, U.K. She joined Signify in 2018 as part of the Healthcare IT team. She holds a first-class biomedical sciences degree from the University of Warwick and is currently focusing on the Breast Imaging market.

Signify's "Breast Imaging - World -- 2019 Edition" provides a data-centric analysis of current and projected demand for cart, compact, and handheld ultrasound systems. It features analysis of 30 geographic markets, with breakdowns by clinical application and product mix. The report is based on a robust primary research method, including sales data reported by vendors of ultrasound equipment.

The comments and observations expressed do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.