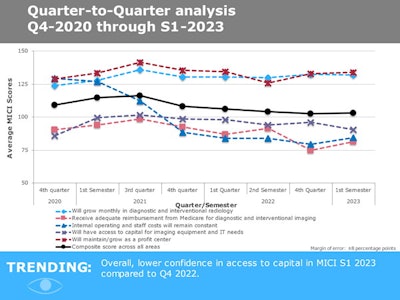

Radiology administrators remain positive that diagnostic and interventional radiology will grow as a profit center in 2023, according to MarkeTech Group's first-quarter 2023 Medical Imaging Confidence Index (MICI) report.

They're also confident that radiology volumes will grow monthly. But they're less optimistic regarding access to capital for imaging and IT needs, that internal operating expenses and staff costs will remain constant, and that their departments will receive adequate Medicare reimbursement for exams -- although this confidence ranking was higher than it was in the fourth quarter of 2022.

"Reimbursement remains a challenge," one survey respondent said. "Salary costs are increasing along with [supply costs] but reimbursement isn't keeping up," another noted. "Reimbursement has been [a struggle] and doctors are ordering fewer higher-level procedures," a third participant wrote.

MarkeTech Group releases the MICI report once a quarter, developing it from survey responses of radiology administrators and business managers who are members of the Association for Medical Imaging Management (AHRA). The document consists of responses to questions about five trends radiology administrators face in the coming year.

This first-quarter data covers the period from January to March and includes information from 141 imaging directors and managers across the following U.S. geographic areas: 8% in the East North Central region; 14% in the West South Central region; 14% in the South Atlantic region;16% in the West North Central region; 10% in the Pacific region; 15% in the East South Central region; and 8% in the Mountain region.

Of the survey participants, 45% reported a hospital/facility size of 100 beds or less, 39% of 100 to 349 beds, and 16% of 350 beds or more.

Respondents rated their confidence on five topics, and MarkeTech calculated a single composite score. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

The report found that confidence is high that radiology will grow as a profit center in the coming year but low adequate reimbursement from Medicare.

| MICI confidence scores by topic | ||||

| Topic | Mean score Q4 2022 | Interpretation | Mean score Q1 2023 | Interpretation |

| Will maintain/grow as a profit center | 133 | Very high | 134 | Very high |

| Will grow monthly in diagnostic and interventional radiology | 133 | Very high | 132 | Very high |

| Will have access to capital for imaging equipment and IT needs | 96 | Neutral | 91 | Neutral |

| Internal operating and staff costs will remain constant | 79 | Low | 84 | Neutral |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 75 | Low | 81 | Low |

| Composite score across all areas | 103 | Neutral | 103 | Neutral |

The survey included a free-response section under which participants weighed in on the five topics. Considering study volume increases, respondents said that "volumes continue to grow," that "we will see more grant funding for expansion," and that there is an "increase in patients due to backlogged cases."

Respondents expressed concern about Medicare reimbursement, writing that "demand for service is high and reimbursement continues to go down," and that "commercial payers are shrinking by the day, [and] Medicare and Medi-Cal patient volume is getting higher with baby boomers retiring while reimbursement is less."

Regarding operating and staff costs, survey participants noted that "it's still very challenging to find full-time staff in some modalities and for weekend and night shifts," that "staffing remains a huge struggle. Everyone wants traveler rates and to only work three days per week with no overnight call," and that "internal hospital operating cost is increasing."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.