Surgical imaging developer Novadaq Technologies expects to raise gross proceeds of approximately $35.1 million from a new public offering.

The firm has priced the 6.1 million newly issued common shares at a public offering price of $5.75 per share. Novadaq has also granted the underwriters of the offering an option to purchase an additional 915,000 common shares at the public offering price during a period ending 30 days from the date of Novadaq's final prospectus supplement filed in connection with the offering.

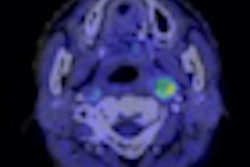

Novadaq said it would use the net proceeds to fund investments required to commercialize Pinpoint, its minimally invasive version of the company's Spy technology. Funds would also be used for general corporate purposes, including funding potential future acquisitions, capital expenditures, the procurement of raw material supply, and for future research and development of new product hardware and new imaging molecules such as those required for nerve imaging, Novadaq said.

Piper Jaffray and Stifel Nicolaus Weisel are acting as joint book-running managers for the offering, while JMP Securities and Rodman & Renshaw are acting as co-managers.

The offering is expected to close on or about April 9, or such other date that Novadaq and the underwriter representatives agree upon.