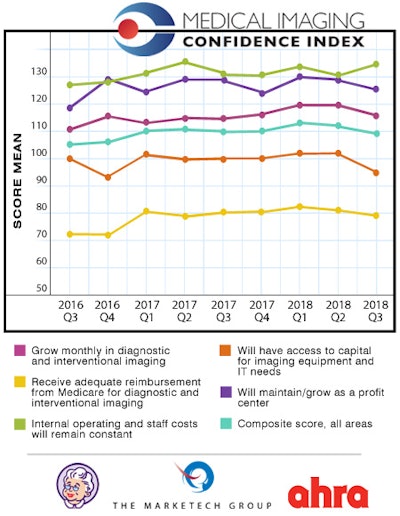

Radiology administrators don't expect any major changes on the horizon when it comes to their business prospects, according to the latest numbers from the Medical Imaging Confidence Index (MICI). However, there was a decline in confidence that healthcare facilities would have access to capital.

The composite MICI score for the third quarter of 2018 came in at 109, down slightly from 112 in the second quarter and a difference that wasn't statistically significant. The index has been floating around the 110 level since the first quarter of 2017.

The index is derived from survey responses of radiology administrators and business managers who are members of the AHRA, the association for medical imaging management. The market research firm MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2018 third-quarter data, the MICI survey included 156 participants from across the U.S., with 13% based in the Mid-Atlantic region, 14% in the South Atlantic region, 6% in the East South Central region, 22% in the East North Central region, 17% in the West North Central region, 13% in the West South Central region, 5% in the Mountain region, and 10% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories also was calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

As in past MICI surveys, radiology administrators were most optimistic that their internal operating and staff costs would remain constant, with a mean score of 135. They were also confident that their facility will maintain or grow as a profit center, with a score of 126, followed by confidence in their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 116.

But confidence that facilities would have access to capital fell 7 points, to a score of 95 from a score of 102 in the second quarter of 2018. And as always, MICI survey respondents were least optimistic about receiving adequate Medicare reimbursement, with a score of 79.

| MICI survey results for 3rd quarter of 2018 | |||

| Topic | Mean score | Interpretation | |

| Internal operating and staff costs will remain constant | 135 | Very high confidence | |

| Will maintain/grow as a profit center | 126 | High confidence | |

| Will grow monthly in diagnostic and interventional radiology | 116 | High confidence | |

| Composite score across all areas | 109 | Neutral | |

| Will have access to capital for imaging equipment and IT needs | 95 | Neutral | |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 79 | Low confidence | |

MICI scores for the third quarter of 2018 and their relationship to the previous eight quarters are shown in the following chart.

In the open-response section of the MICI survey, radiology administrators and business managers expressed different levels of confidence in their business prospects. A number of respondents reported that they were experiencing strong procedure volumes, a trend they expected to see continue into the next quarter.

On the negative side, one respondent reported that "staff costs are in wild flux" due to personnel vacancies, and they have been forced to resort to short-term staffing agencies for help. In addition, reimbursement continues to be a problem, with higher patient deductibles beginning to affect patient volumes.