Radiology administrators are cautiously optimistic about their prospects for the second quarter of 2019. But concerns about pre-authorization for imaging studies and the growing migration of imaging exams to outpatient facilities is causing concern, according to the latest numbers from the Medical Imaging Confidence Index (MICI).

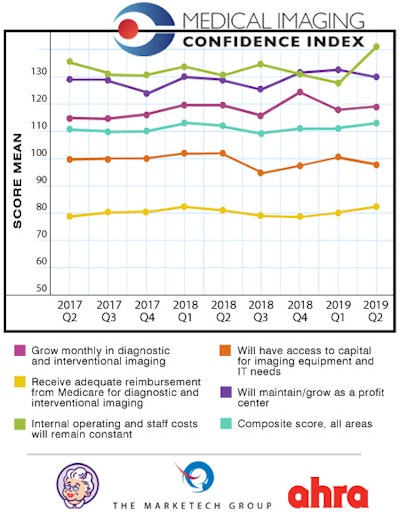

The composite index score for the second quarter of 2019 was 113, which MICI classifies as having "high confidence" in future business prospects. The figure is up slightly compared with the composite score of 111 for the first quarter of 2019.

The MICI is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2019 second-quarter data, the index included 170 participants from across the U.S., with 15% based in the Mid-Atlantic region, 17% in the South Atlantic region, 6% in the East South Central region, 21% in the East North Central region, 18% in the West North Central region, 9% in the West South Central region, 5% in the Mountain region, and 10% in the Pacific region.

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

Radiology administrators were most optimistic that their internal operating and staff costs would remain constant, with a score of 141. They were also confident that they would maintain/grow as a profit center, with a mean score of 130, followed by confidence in their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 119.

At the bottom was their confidence that they would receive adequate reimbursement from Medicare, with a score of just 82, a finding comparable to previous surveys.

| MICI scores by topic for Q1 2019 | ||

| Topic | Mean score | Interpretation |

| Internal operating and staff costs will remain constant | 141 | Very high confidence |

| Will maintain/grow as a profit center | 130 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 119 | High confidence |

| Composite score across all areas | 113 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 98 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 82 | Low confidence |

MICI scores for the second quarter of 2019 and their relationship to the previous eight quarters are shown in the following chart.

In the free-response section of the survey, some MICI panelists expressed optimism as growth in patient volume and money for capital equipment purchasing becomes available.

"Our facility is doing well, and I really anticipate this to continue over the next 3 to 6 months," one respondent said.

But others express concern about the growing trend to require referring physicians to receive pre-authorization before patients can receive imaging exams. Pre-authorization approvals are getting more difficult to obtain and are a "major deterrent to timely imaging for patients."

Other MICI respondents see the ongoing trend in which imaging exams are being shifted from hospitals to outpatient settings as a negative trend.

"Insurance companies are now starting to require their patients to go to outpatient imaging centers that purchase low-end refurbished equipment and severely undercut prices," one respondent said. "Insurance companies continue to maintain the advantage of what care patients receive."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.