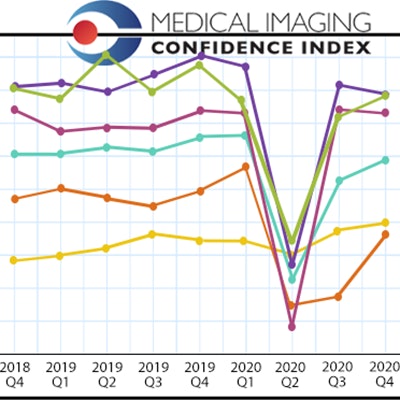

Radiology administrators and business managers are reporting that imaging exam volumes have rebounded since their nadir during the COVID-19 pandemic, according to the latest numbers from the Medical Imaging Confidence Index (MICI). But uncertainty still abounds as the fallout from the outbreak continues.

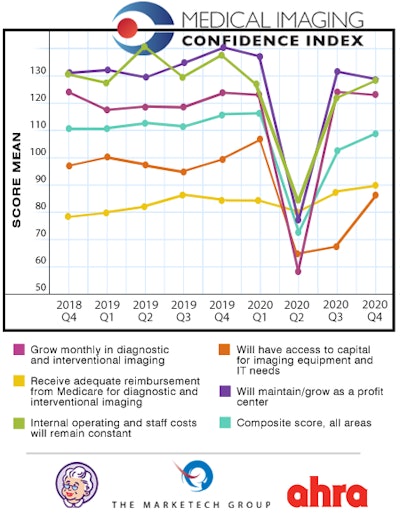

The composite MICI score for the fourth quarter of 2020 was 109, based on responses by administrators and business managers to a set of questions on their outlook for the current quarter. That compares with a composite MICI score of 103 in the third quarter of 2020, and 72 in the second quarter, at the bottom of the COVID-19 pandemic.

The Medical Imaging Confidence Index is derived from survey responses of radiology administrators and business managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2020 fourth-quarter data, the index included 151 participants from across the U.S., with 14% based in the mid-Atlantic region, 16% in the South Atlantic region, 4% in the East South Central region, 22% in the East North Central region, 16% in the West North Central region, 12% in the West South Central region, 8% in the Mountain region, and 10% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

| MICI scores by topic for Q4 2020 | ||

| Topic | Mean score | Interpretation |

| Internal operating and staff costs will remain constant | 129 | High confidence |

| Will maintain/grow as a profit center | 129 | High confidence |

| Will grow monthly in diagnostic and interventional radiology | 124 | High confidence |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 90 | Low confidence |

| Will have access to capital for imaging equipment and IT needs | 86 | Low confidence |

| Composite score across all areas | 109 | High confidence |

MICI scores for the fourth quarter of 2020 and their relationship to the previous eight quarters are shown in the following chart.

Radiology administrators and managers who responded to the MICI survey noted in the free-response section of the survey that imaging volumes had bounced back from the lows seen in the second quarter, and in some cases were 95% of normal. But COVID-19 is casting a long shadow, as many patients are still reluctant to return to hospitals and imaging centers.

Additionally, the long-term financial ramifications of the COVID-19 pandemic are just beginning to become known.

"COVID has brought severe uncertainty regarding cash flow and capital allocations," one respondent noted. "2021 will bring a new direction and new strategy for growth."

Other respondents noted a freeze in capital for new equipment purchases. Some reported staff cuts of as much as 20% across their organization.

"COVID-19 had a huge impact on our organization, like many others," the respondent noted. "There will be no capital purchases for the remainder of the year unless something necessary for operations breaks and cannot be repaired."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.