Radiology administrators are struggling to cope with rising staff costs and personnel shortages as they also try to manage a variety of financial pressures, according to the latest numbers from the Medical Imaging Confidence Index (MICI).

Administrators and business managers are getting squeezed between rising procedure volume, dropping reimbursement, and a shortage of personnel like radiologic technologists that is forcing them to spend more time on recruitment and pay higher rates to staffing agencies.

"Although we see our volumes continue to grow our expenses, (staffing costs in particular) continue to outgrow revenue," one MICI respondent said. "This limits our ability to grow and access capital dollars."

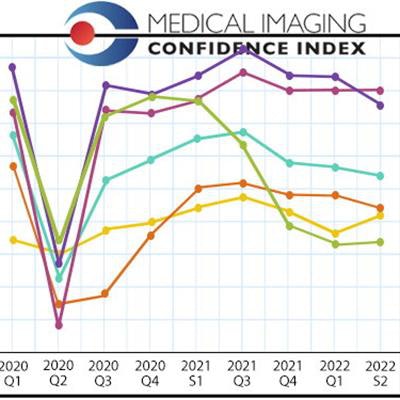

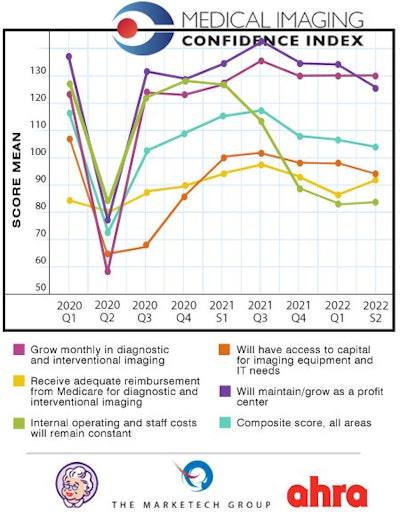

The Medical Imaging Confidence Index is derived from survey responses of radiology administrators and business managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

The 2022 second-semester data covers the period from April to September. The index included 145 participants from across the U.S., with 12% based in the mid-Atlantic region, 14% in the South Atlantic region, 16% in the East South Central region, 8% in the East North Central region, 16% in the West North Central region, 14% in the West South Central region, 7% in the Mountain region, and 12% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

| MICI scores by topic for second semester of 2022 | ||

| Topic | Mean score | Interpretation |

| Will grow monthly in diagnostic and interventional radiology | 130 | High confidence |

| Will maintain/grow as a profit center | 126 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 94 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 92 | Low confidence |

| Internal operating and staff costs will remain constant | 84 | Low confidence |

| Composite score across all areas | 104 | Neutral |

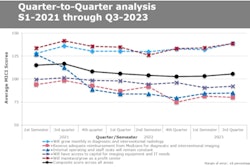

MICI scores for the second semester of 2022 and their relationship to the previous eight periods are shown in the following chart.

In the free-response section of the survey, respondents further elucidated on their concerns about staffing costs.

"Incredibly short-staffed," one respondent noted. "Will need agency staff to help cover, which will result in increased costs. Will also need to [close] rooms down because we don't have enough techs to staff."

Other MICI respondents confirmed that rising costs are resulting from the personnel shortage.

"Staff is extremely hard to come by," one administrator stated. "We are at bare minimums. There are no applications coming in for the open [jobs] that we have. Traveling techs are getting sky-high rates."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.