Radiology administrators have very high confidence that diagnostic and interventional radiology exam volumes will grow in 2023, according to fourth-quarter 2022 numbers from the Medical Imaging Confidence Index (MICI).

The report, generated by MarkeTech Group, also shows that imaging administrators have very high confidence in their facilities growing as a profit center -- especially as the U.S. population ages.

"As the population gets older, there is more [imaging] that will need to be done and this will drive up volume ... and reimbursement," one survey respondent said.

But administrators have less confidence that internal operating and staff costs will remain stable and that their facility will receive adequate reimbursement from Medicare for diagnostic and interventional imaging.

"The cost of contract labor, incentive pay, recruiting bonuses, and retention bonuses are taking a toll on the bottom line," another respondent stated.

MarkeTech Group releases the MICI report once a quarter, developing it from survey responses of radiology administrators and business managers who are members of the Association for Medical Imaging Management (AHRA). The report consists of responses to questions about five trends radiology administrators face the upcoming quarter in an effort to gauge sentiment about near-term business prospects.

"[The MICI results capture] the 'mood' of imaging administrators on a quarterly basis regarding the state of medical imaging in the U.S.," MarkeTech Group said.

The 2022 fourth quarter data covers the period from October to December and includes information from 132 participants across the following U.S. geographic areas: 18% in the East North Central region, 15% in the West South Central region, 14% in the South Atlantic region, 14% in the West North Central region, 11% in the Pacific region, 7% in the East South Central region, and 7% in the Mountain region.

Regarding hospital/facility size, most are small, with 43% having 100 beds or less, 39% having 100 to 349 beds, and 18% having 350 beds or more.

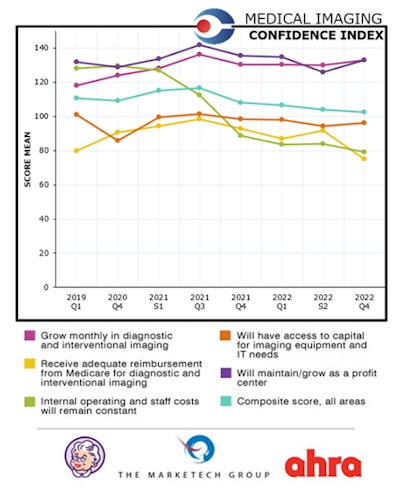

In the report, respondents rated their optimism about the five topics; MarkeTech then calculated a single composite score including all five categories. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

The report found that confidence is high that diagnostic and interventional radiology volumes will grow in coming months but low regarding the stability of costs and reimbursement.

| MICI fourth-quarter 2022 scores by topic | ||

| Topic | Mean score | Interpretation |

| Will grow monthly in diagnostic and interventional radiology | 133 | Very high confidence |

| Will maintain/grow as a profit center | 133 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 96 | Neutral |

| Internal operating and staff costs will remain constant | 79 | Low confidence |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 75 | Low confidence |

| Composite score across all areas | 103 | Neutral |

The survey included a free-response section under which participants weighed in on the above topics. Considering study volume increases, one respondent said that there's "always an increase in imaging at the end of the calendar year, [as] patients look to [get care before they meet their deductibles]." Another noted that "volumes are trending upward -- along with costs -- as [we come] out of the COVID period." And one survey participant wrote that "there will be more capital spending in 2023 compared to 2022."

Respondents expressed more concern -- at times quite strongly -- about internal operating and staff costs and how trends in these areas could affect patient care.

"It's very challenging to hire full-time staff," one survey participant wrote. "The department is relying on travelers to staff the department." Another noted that "patient care delays, especially for screening studies, will result in increased cancer at later stages and a higher level of acuity due to access issues." And a third cautioned that "supply costs are up dramatically, so expenses are up."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.