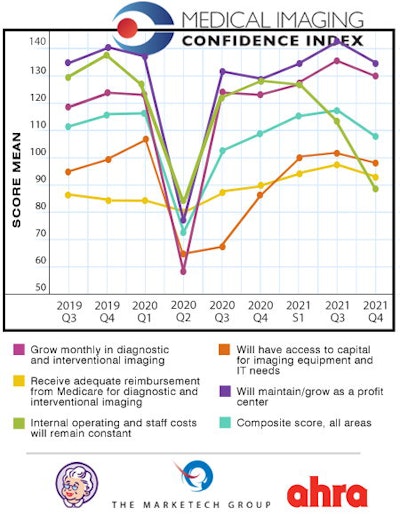

Medical imaging volume continues to grow strongly as radiology recovers from the depths of the COVID-19 pandemic. But rising labor costs are bedeviling radiology administrators, according to survey results for the fourth quarter of 2021 in the Medical Imaging Confidence Index (MICI).

The MICI index has seen a major plunge in the past year in the data point tracking administrator confidence in keeping operating and staff costs constant. Respondents to the MICI poll are reporting rising costs across the board, from equipment service to consumable supplies.

And one of the biggest costs to running a radiology operation -- labor and staffing -- is also rising as facilities report a shortage of radiologic technologists.

"Staffing costs are increasing at an incredible rate," reported one MICI panelist.

The Medical Imaging Confidence Index is derived from survey responses of radiology administrators and business managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2021 fourth-quarter data, the index included 138 participants from across the U.S., with 19% based in the mid-Atlantic region, 14% in the South Atlantic region, 5% in the East South Central region, 20% in the East North Central region, 16% in the West North Central region, 8% in the West South Central region, 3% in the Mountain region, and 5% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

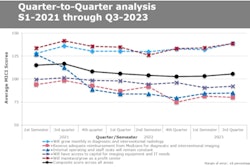

MICI respondents were most confident that their facility would continue to maintain and grow as a profit center, with a score of 135, indicating high confidence. That compares with a score of 142 in the third-quarter edition of the poll.

But they expressed low confidence that their internal operating and staff costs would remain constant, with a score of 89. That compares with a score of 113 as recently as August 2021, and a score of 129 in this metric just over a year ago.

| MICI scores by topic for Q4 2021 | ||

| Topic | Mean score | Interpretation |

| Will maintain/grow as a profit center | 135 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 130 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 98 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 93 | Neutral |

| Internal operating and staff costs will remain constant | 89 | Low confidence |

| Composite score across all areas | 108 | Neutral |

MICI scores for the fourth quarter of 2021 and their relationship to the previous eight quarters are shown in the following chart.

In the free-response section of the survey, some respondents reported that imaging volumes have grown and in some cases are higher than the levels reported prior to the COVID-19 pandemic, which depressed radiology volumes as patients deferred nonessential exams.

"We had the highest number of radiology procedures performed in [fiscal 2021] ever recorded at my facility," one panelist said.

But reimbursement continues to decline as payors drive patients to lower-cost options for imaging like freestanding imaging centers. And costs are rising, as vaccine requirements lead to staff vacancies, several respondents reported.

"Recruiting and retaining full-time staff has become increasingly difficult," said a MICI panelist. "Finding qualified travel technologists has become more difficult."

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.