Radiology administrators and imaging managers appear confident that their operations will maintain or increase growth in the wake of the COVID-19 pandemic, even as they continue to express concern about how study volume will rebound, according to the Medical Imaging Confidence Index (MICI) for the first half of 2021.

The index is an effort to capture the mood of radiology administrators and business managers regarding the state of medical imaging in the U.S. To produce it, the AHRA collaborates with market research firm the MarkeTech Group on a survey of AHRA members regarding key trends they expect to encounter over the coming months.

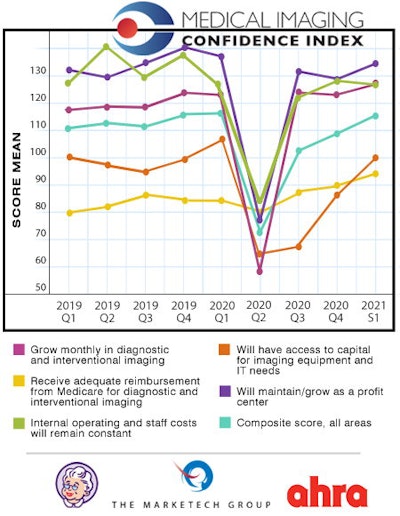

For the first half of 2021, the index showed a composite score -- reflecting all five imaging-related MICI categories -- of 115 (high confidence), an increase from 109 in the fourth quarter and 103 in the third quarter of 2020.

Data came from 160 participants across the U.S. Of these, 11% hailed from the Mid-Atlantic region, 18% from the South Atlantic region, 9% from the East South Central region, 21% from the East North Central region, 17% from the West North Central region, 10% from the West South Central region, 6% from the Mountain region, and 8% from the Pacific region.

The survey cohort rated their optimism about five topics, and a single composite score that includes all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- Less than 50: Extremely low confidence

- 50 to 69: Very low confidence

- 70 to 89: Low confidence

- 90 to 110: Neutral

- 111 to 130: High confidence

- 131 to 150: Very high confidence

- More than 150: Extremely high confidence

The results showed that respondents are optimistic about continued growth in imaging overall as a profit center, but they're less positive about receiving Medicare reimbursement for diagnostic or interventional imaging.

| MICI scores by topic for first half of 2021 | ||

| Topic | Mean score | Interpretation |

| Will maintain or grow as a profit center | 134 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 128 | High confidence |

| Internal operating and staff costs will remain constant | 127 | High confidence |

| Will have access to funds for imaging equipment and IT | 100 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 94 | Neutral |

| Composite score across all topics | 115 | High confidence |

The first-half 2021 MICI scores and their relationship to the previous eight reporting periods are shown in the following chart.

Some survey participants offered comments in the free-response section that further illuminated their perspective on the industry, particularly the effects of COVID-19.

"As long as pandemic exposure rates continue to remain low, I expect to see continued improvement [in study volume increases]," one respondent wrote. "But if they spike again, we will see another decline."

Another participant noted that their facility is "still catching up from the losses of COVID in 2020. We feel once vaccines are in place, patients will feel more comfortable with coming in for treatment ... [but] we are also concerned with patients losing jobs and high deductibles."

The respondents also expressed concern about the financial effects of COVID-19.

"There is significant unknown in any business right now," one person wrote. "We are wanting to expand, but with the hit we took financially during the pandemic, we are balancing a budget based on 2019 information."

This financial fallout is making administrators somewhat cautious when it comes to making purchases.

"While we may have funding available for capital expenses, we will be very cautionary about spending money until we see how the pandemic plays out now that vaccines are being administered," a participant noted.

MICI is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm the MarkeTech Group.