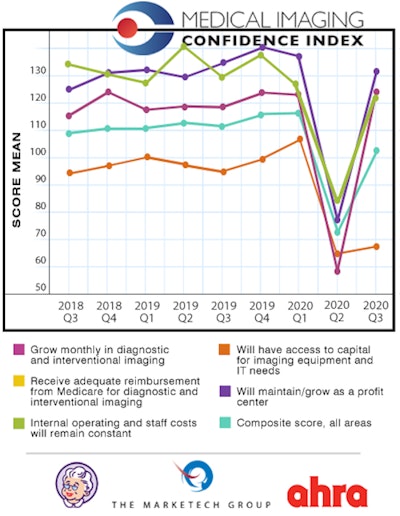

Radiology administrators and business managers reported a sharp rebound in optimism about their business prospects for the third quarter in the latest round of the Medical Imaging Confidence Index (MICI). The jump corrects much of the second-quarter decline that occurred at the beginning of the COVID-19 outbreak.

The composite MICI score for the third quarter was 103, which is interpreted as representing "neutral" confidence by the MICI scale. By contrast, the composite score for the second quarter was 72, indicating "low confidence" and the lowest level in the index's history.

The second quarter of 2020 saw image volume plunge at radiology departments and imaging centers as many sites postponed elective exams as they prepared for the COVID-19 outbreak. But the current numbers for the upcoming quarter indicate that administrators and managers are gaining more confidence as radiology facilities begin to resume normal operations.

The Medical Imaging Confidence Index is derived from survey responses of radiology administrators and business managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2020 second-quarter data, the index included 161 participants from across the U.S., with 14% based in the mid-Atlantic region, 15% in the South Atlantic region, 6% in the East South Central region, 20% in the East North Central region, 15% in the West North Central region, 12% in the West South Central region, 8% in the Mountain region, and 10% in the Pacific region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

| MICI scores by topic for Q3 2020 | ||

| Topic | Mean score | Interpretation |

| Internal operating and staff costs will remain constant | 121 | Very high confidence |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 88 | Low confidence |

| Will maintain/grow as a profit center | 131 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 67 | Neutral |

| Will grow monthly in diagnostic and interventional radiology | 125 | High confidence |

| Composite score across all areas | 103 | High confidence |

MICI scores for the third quarter of 2020 and their relationship to the previous eight quarters are shown in the following chart.

In the free-response section of the survey, administrators and managers who were surveyed noted that while business is starting to return to a semblance of normal, COVID-19 continues to cast a long shadow over radiology operations.

"Volumes are not returning to a pre-COVID level proportional to the phased-opening approach," one respondent explained. "Due to the new norm (social distancing, etc.), productivity will decrease for a while until [the] department can identify mitigation strategies. Due to the losses in revenue, systems will probably freeze capital expenditures."

Several respondents reported that capital spending on equipment has been frozen for the duration of the COVID-19 crisis -- however long that is.

"Our organization has halted all capital purchases for the remainder of the year due to the massive financial loss during COVID-19 quarantine," one noted.

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.