Radiology administrators and business managers were mostly optimistic about their business prospects in the first quarter of 2019, according to the latest numbers from the Medical Imaging Confidence Index (MICI). But there are some possible storm clouds on the horizon.

The composite index score for the first quarter of 2019 was 111, which MICI classifies as expressing "neutral" confidence in future business prospects. The figure is identical to the composite score of 111 for the fourth quarter of 2018.

The Medical Imaging Confidence Index is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Market research firm the MarkeTech Group queries members of the MICI panel about five important trends faced by radiology administrators in the upcoming quarter to provide a barometer of their sentiment about near-term business prospects.

For the 2019 first-quarter data, the index included 182 participants from across the U.S., with 16% based in the Mid-Atlantic region, 17% in the South Atlantic region, 6% in the East South Central region, 20% in the East North Central region, 17% in the West North Central region, 10% in the West South Central region, 5% in the Mountain region, and 9% in the Pacific region.

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also calculated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

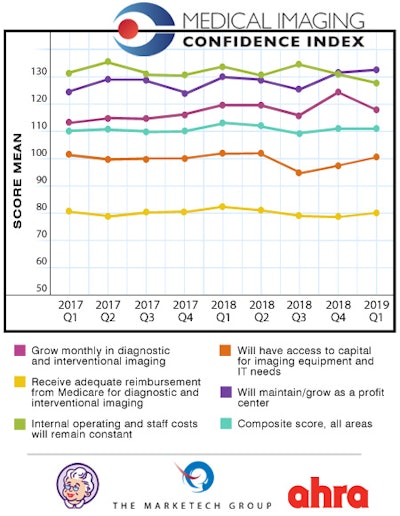

Radiology administrators were most optimistic that they would maintain/grow as a profit center, with a mean score of 132. They were also confident that their internal operating and staff costs would remain constant, with a score of 128, followed by confidence in their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 118.

At the bottom was their confidence that they would receive adequate reimbursement from Medicare, with a score of just 80, a finding comparable to previous surveys.

| MICI scores by topic for Q1 2019 | ||

| Topic | Mean score | Interpretation |

| Will maintain/grow as a profit center | 132 | Very high confidence |

| Internal operating and staff costs will remain constant | 128 | High confidence |

| Will grow monthly in diagnostic and interventional radiology | 118 | High confidence |

| Composite score across all areas | 111 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 101 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 80 | Low confidence |

MICI scores for the first quarter of 2019 and their relationship to the previous eight quarters are shown in the following chart.

In the free-response section of the survey, some MICI panelists expressed optimism about rising procedure volumes and reimbursement levels for the beginning of 2019, in particular with interventional radiology. Many said they are seeing a shift in procedures from the hospital to outpatient settings, particularly as payors try to steer patients away from hospitals.

But preauthorization continues to be a concern, with some outpatient centers resorting to performing only cash-only exams. As always, the U.S. Centers for Medicare and Medicaid Services continues to exert downward pressure on Medicare reimbursement.

The Medical Imaging Confidence Index (MICI) is a joint research collaboration between AHRA, the association for medical imaging management, and market research firm The MarkeTech Group.