It's said there are only two certainties in life -- death and taxes -- but radiology practitioners in the U.S. are learning that a reduction in compensation for exams is a third foregone conclusion.

The U.S. Centers for Medicare and Medicaid Services (CMS) has slashed its reimbursement rates for many imaging services next year, and because the private insurance sector utilizes these numbers to determine its payment benchmarks, private payor reductions will not lag too far behind.

Rod Tidwell, the fictional Arizona Cardinals football player in the film Jerry Maguire, is best known for repeatedly exclaiming, "Show me the money," which is precisely what radiology practices need to do to stay competitive and profitable, according to Patricia Kroken.

Kroken, a principal in Healthcare Resource Providers, an Albuquerque, NM-based radiology business consulting firm, shared her insights on analyzing billing effectiveness -- which is all about the money -- with attendees at the 2006 Radiology Business Management Association (RBMA) conference in Phoenix.

"One of the things you want to see is balance between your days in accounts receivable (A/R), your days in adjusted collections, and your bad-debt write-off," she said. "What you want is a good performance level in each of these areas."

To determine if there is balance among these three elements, and if the performance of each element is within an acceptable range, a practice must monitor its trends over time in these areas to identify variances.

"You want to strive for consistency, although the world will make sure you never get it," Kroken said. "Variances usually occur as a result of an operational problem, and where they occur helps you investigate that internal process."

This means that the same things can be monitored to determine performance improvement opportunities and where potential problems lie in a practice's formalized billing processes, she said.

Volume and charge entry

Practice exam volume is very important to track and it should be correlated with charge entry; a dip in one should show in the other. According to Kroken, problems are more difficult to identify when tracking charge entry only, but many groups monitor just the money -- which makes it difficult to catch an issue early.

Charge entry monitoring is a key element of billing analysis because erratic patterns impact cash flow; however, natural variances also occur. Kroken said a short work month will usually show a drop, as will vacation schedules or turnover in a smaller practice.

By examining both the average daily and monthly charges, a manager can calculate the variances and assign causes, such as a short month qualifier, or determine if a problem has occurred and corrective action needs to be taken.

Payments and collections

"Payments are usually less dramatic, in terms of variability, than are charges," Kroken said.

When variances in payments occur they can generally be attributed to problems with electronic file transmissions, backlogs in payment posting, payor problems, or staffing issues, she said.

Kroken recommends managing payment variances by identifying and monitoring average daily activity. If an administrator sets a daily quota that is communicated to the staff, they will generally self-monitor for that value, she said.

When a drop is seen in payments, a manager can investigate the cause. Kroken suggested that hospital data transfer systems should be scrutinized and that administrators should determine where the payment backlog is in the practice.

"If you monitor closely, you can minimize the impact for the month," she said.

To determine gross collection percentages, a practice will want to compare payments to charges. The ratio will vary from group to group based on the fee schedule and contracted rates.

A baseline "normal" value should be determined for the group, which is important because radiologists calculate buy-in and buy-out numbers for the practice on the basis of the gross collection percentage, she said.

Variances in gross collection percentages are usually caused by adjustment problems, such as a large volume of timely filing denials or medical necessity denials on high-dollar procedures.

Kroken recommended checking adjustments and denials to find the source of the variation, such as new a physician provider number or operational problems that are causing the denials.

Adjusted collection percentages are determined by deducting contractual discounts and adjustments from gross charges to obtain a target amount that could be collected. Adjustments can spike for medical necessity or similar reasons, resulting in a negative net -- which is never a good sign, Kroken noted.

Accounts receivable and staff

Determining an average value for how many days a bill is in A/R is a good indicator of how quickly cash is turning in the practice, whether or not follow-up is occurring, and a group's investment in billing technology, Kroken said.

For example, she said that a days-in-A/R value of less than 45 indicates a heavy use of technology such as front-end editing and natural language processing (NLP) applications for coding. A 55-day value shows good performance, electronic processes in place, and that the A/R distribution is well-balanced.

A 60-day value represents average performance, while a 72-day value is an indicator of problems such as work backlogs, a heavy private payor mix, and a greater reliance on paper claims, she said. A value of 75-days or higher is generally a sign that a practice is heavily invested in manual processes, or that problems exist with its information systems.

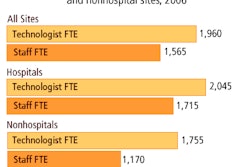

Staffing ratios of billing personnel to radiologists is also an effective benchmark for determining billing efficiencies, Kroken said. A ratio of less than one full-time equivalent (FTE) billing staff per radiologist suggests the practice has maximized its technology use; conversely, a ratio of two FTEs per radiologist is indicative of a billing group that is underperforming, relying too heavily on manual processes, and is in need of extensive rework.

A 1:1 ratio demonstrates an effective use of computer technology and proactive management, she said.

Process analysis

Each process, manual and technological, conducted by the billing group within a radiology practice should be broken down into its workflow components and documented, Kroken said. In addition, each staff member should be asked to offer one or two changes in workflow that they believe will help improve their productivity.

These workflow process documents will provide a manager with a roadmap they can use to analyze problems and inconsistencies, and identify the area in which they occur. Process analysis should be conducted on a regular basis as workflow will change in response to new technology and payor requirements, she noted.

There are no bad people only bad processes when it comes to billing effectiveness, Kroken observed. Creating and maintaining an efficient billing group is a matter of defining and delivering the right processes and technologies, and managing them.

"You want to look for variances and trends; look for the operational causes and move quickly to correct them. You want to set expectations and communicate them so that people know what you want out of them," Kroken said. "You want to maintain a balance of indicators and review your processes periodically."

By Jonathan S. Batchelor

AuntMinnie.com staff writer

November 17, 2006

Related Reading

Revenue cycle review helps imaging centers face challenges to come, August 25, 2006

Increase image reimbursement with a designated coder, August 7, 2006

DRA cuts affect more than imaging providers, August 2, 2006

Improve what? Finding a process to improve, July 27, 2006

DRA 2005 in practice: Where the rubber meets the road, April 27, 2006

Copyright © 2006 AuntMinnie.com