PET developer Positron has labored literally for decades to make cardiac PET a clinical reality. The company's effort was paying off until late last year, when the market got sidetracked by a disruption in the supply of rubidium-82, the main cardiac PET radiopharmaceutical. Positron's solution? Grow your own.

Not literally grow it, of course, but Positron has embarked on a plan to stabilize the rubidium-82 pipeline both in the short and long term by developing its own capability to produce strontium-82, the precursor isotope to rubidium-82. The company believes that a more stable supply of strontium and rubidium will lead to increased sales of its cardiac PET scanners, and help the company evolve into an end-to-end supplier of cardiac PET equipment and radiopharmaceuticals.

Positron was launched in 1983 with a focus on cardiac PET using rubidium-82. The company has stayed true to that message in the years since, and it's now one of the only companies making a dedicated PET camera in a market that has shifted completely to PET/CT technology targeted at oncology applications.

Positron has positioned its Attrius PET system as a more economical alternative to PET/CT systems, enabling sites to move into cardiac PET at a list price of about $800,000, some $1 million cheaper than the PET/CT cameras from the major vendors, according to Pat Rooney, CEO of the company.

Positron believes that cardiac PET has a number of advantages over cardiac SPECT, which for years has been the workhorse modality for functional cardiac imaging. These include better image quality, lower radiation dose, and higher insurance reimbursement rates. Perhaps in acknowledgement of these advantages, the cardiac PET market had increased tenfold over the past five years as measured by the number of sites receiving rubidium-82 generators, according to Rooney.

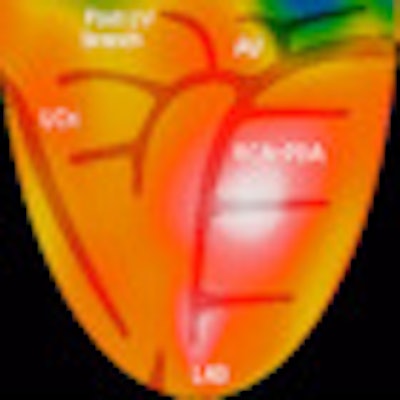

|

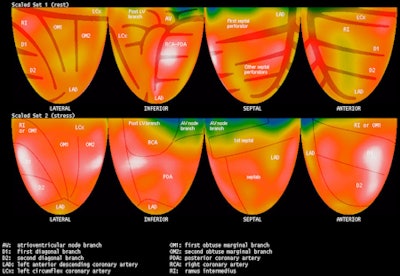

| PET image demonstrates a Mercator projection of rest and stress images using rubidium-82, with an overlaying theoretical coronary artery anatomy tree, as well as distribution zones. Image courtesy of Positron. |

Another advantage was that cardiac PET had a more stable supply of radioisotopes compared to molybdenum-99, the precursor to technetium-99m, the mostly widely used SPECT agent. Molybdenum supplies have been disrupted repeatedly over the years, with the most recent outage lasting more than a year, when the Canadian reactor that supplies the radioisotope to North America went offline in May 2009.

Cardiac PET sites produce their isotopes using generators based on strontium-82, which decays into rubidium-82. Strontium-82 is typically very expensive to produce and usually comes from government laboratories like those run by the U.S. Department of Energy, which supplies all of the strontium-82 used in the U.S. for medical purposes.

That supply had been relatively stable over the years, but the situation changed in late 2011, when Bracco Diagnostics pulled its CardioGen-82 generators from the U.S. market. Bracco was responding to concerns raised by the U.S. Food and Drug Administration (FDA) after several patients who had been injected with CardioGen-82 were found to have higher-than-expected levels of radiation after the tests.

Ultimately, Bracco and the FDA determined that the incidents were mostly likely due to user error in handling rubidium-82 generators, and the company expects to resume CardioGen-82 shipments in the first quarter of this year. But the episode lit a fire under Position executives to try to gain more control of their own destiny.

"We recognized that a sole-source supplier could lead to instability or reluctance from buyers," said Joseph Oliverio, chief technology officer and director of clinical programs at Positron. "We are taking the responsibility to stabilize and increase the strontium supply within the market."

Positron earlier last month closed on its acquisition of Manhattan Isotope Technology, which specializes in the processing of strontrium-82 at a facility in Lubbock, TX. In the first quarter, the Lubbock site will begin receiving strontium-82 from a cyclotron operated by Arronax in France, and will offer it to companies such as Bracco pending the approval of a drug master file by the FDA.

Farther down the road, Positron is developing a longer-term supply by building its own 70-MeV cyclotron facility, to be operated at a site in Noblesville, IN. The company has received $6.7 million in tax incentives from the local government, as well as a $38 million private bond that will be granted by the state of Indiana, allowing investors to invest in the project tax-free while Positron receives the proceeds. Rooney estimates that it will take three years to build the cyclotron facility. At that point, Positron will be able to produce strontium-82 on its own.

All told, the company hopes that its short- and long-term efforts will bolster the confidence of sites debating a switch to cardiac PET but apprehensive about radioisotope supplies.

"We believe that PET is the new SPECT," Rooney said. "We don't think it replaces SPECT, but there is a great movement from SPECT to PET. PET is much better for the patient, practice, and payors than SPECT."