In 2021, the global ultrasound market recovered strongly from the disruption caused by the COVID-19 pandemic, with double-digit growth pushing market revenues above 2019 levels.

After such a strong recovery, growth in 2022 was expected to be muted, but global supply chain issues, the Russia conflict with Ukraine, and other geopolitical challenges have added new uncertainty and disruption to the market.

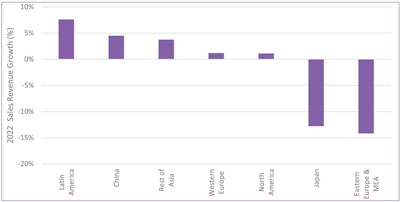

Despite these headwinds, the ultrasound market has held-up reasonably well in the first half of the year and is expected to remain broadly flat over the full year, with a small decline of 0.7% forecast for all of 2022. The main regional growth trends are discussed below.

Country growth in 2022 by order of largest percentage growth

Country growth in 2022 by order of largest percentage growthWestern Europe -- Correctional decline from 2020

After the Western European market experienced strong growth in 2020, fueled by COVID-related tenders, the market declined in 2021. Benelux was the best-performing Western European market in 2021, partly as it was the only market to have retracted in 2020. The U.K. market experienced further growth in 2021, despite strong growth in 2020. This was due to continued purchasing for COVID, a strong private sector, and increased investment in the National Health Service (NHS).

Considering the supply chain challenges and the Russia/Ukraine war, limited growth is forecast for the Western European market in 2022. The war, coupled with the rapidly worsening outlook for the global economy, has created hesitancy to invest in healthcare equipment, which has stunted the 2022 growth potential.

Eastern Europe, Middle East & Africa: Russia invasion of Ukraine driving decline

Growth in the Eastern European ultrasound market was strong in 2021, with estimated growth of over 30%. As a result of the Russia/Ukraine war, Signify Research forecasts a market decline in 2022, driven by a projected heavy decline in the Russian market.

A correctional double-digit decline is forecast for the rest of the Eastern European market in 2022, with a smaller single-digit decline forecast for Poland. The decline could be more substantial should the situation with Russia and the surrounding Eastern European countries worsen.

The Middle East and Africa (MEA) market is estimated to have grown in 2021, driven by the strong performance of the Turkish market, with the large 809-unit Ministry of Health tender funded by the European Bank for Reconstruction and Development (ERBD) delivered that year. The increase in oil prices in 2022 and increased oil purchases in the Middle East region as countries look for alternative supplies to Russia, will drive growth for the ultrasound market in the Middle East.

The African market experienced a small decline in 2021, following on from a larger decline in 2020. The decline in 2021 was mainly due to a steep market decline in South Africa.

The African market is forecast to return to growth in 2022. Supply chain challenges have led to increased system prices globally in 2022. However, due to the price-sensitive nature of customers in the African market, it is one of the only markets that will not follow this. It means some vendors may have to walk away from deals and this will further open the market to lower-cost Chinese vendors.

North America -- slowdown expected in the second half of the year

The ultrasound market recovered strongly in the U.S. in 2021, surpassing 2019 revenue levels. One of the main drivers of growth was increased investment in imaging equipment to help address the backlog of procedures. The radiology market was a key growth driver, primarily from sales of premium systems.

Following exceptionally high growth in the U.S. market in 2021, Signify Research predicts the ultrasound market will experience a correctional slowdown in 2022, fueled by other global headwinds such as the supply chain challenges. However, the market has remained relatively strong in the first half of 2022, and whilst the market is forecast to slow down in the second half of 2022, growth is still expected.

In Canada, the Conservative Party made a bid to address the backlog for medical imaging services, reduce wait times, and improve access to diagnostic and interventional procedures, by pledging to invest 1.5 billion Canadian dollars ($1.1 billion U.S.) in medical imaging equipment over four years as one of their key priorities leading up to the 2019 federal election. Some of this investment is expected for ultrasound, and the high growth seen in the Canadian ultrasound market in 2021 suggests this is the case.

Latin America -- Beginning to recover from the COVID-19 pandemic

Latin America (LATAM) was one of the fastest-growing markets for ultrasound in 2021, driven by strong growth in Brazil and several of the smaller ultrasound markets in the region. There were no big, centralized tenders in Mexico in 2021 and the market is estimated to have remained broadly flat.

The LATAM market is forecast to recover to 2019 revenue levels by the end of 2023. Whereas supply chain challenges will impact most markets in 2022 and 2023, the impact in the LATAM region will predominantly be in 2022. Tender analysis in the LATAM region is typically more short term and purchasing decisions are made quickly.

Despite the strong growth in Brazil in 2021, there is room for more growth in 2022, especially in radiology, where some large accounts were not ready to purchase systems in 2021. We forecast another strong year of growth in 2022, mainly driven by the public market, which in turn will push the private market to also invest. The veterinary ultrasound market is forecast to grow strongly in 2022, as veterinary practices look to vendors for education and support to enter new markets and add new service lines.

The lack of big tenders in Mexico in 2020 and 2021 suggests increased investment is due in 2022. Signify Research forecasts high-single-digit growth in 2022, driven by a large tender by the Instituto Mexicano del Seguro Social (IMSS). Low growth is forecast for the rest of the Americas region in 2022, a correction from the high growth in 2021.

China -- Government investment will drive growth

The China ultrasound market is estimated to have grown by around 10% in 2021. The outbreak of new waves of COVID-19 cases this year has led to regional lockdowns as the China government continues to take a zero-COVID approach. These lockdowns will not have the same negative impact on the market as the lockdowns in 2020 but will dampen market growth.

The government introduced a new local manufacturing policy in May 2021, which requires international vendors to obtain certification of local production. Local Chinese vendors such as Mindray, SonoScape, and Chison were able to capitalize on this policy change.

A key growth driver in the coming years will be government investment in rural and primary healthcare, both through the building of new hospitals and upgrading existing hospitals. The investment will be for all ultrasound clinical applications. The China market is projected to remain smaller than the U.S. market during the forecast period, despite having a much larger population.

Japan -- A market correction after the 2021 government supplemental budget

The Japan ultrasound market saw large growth in 2021, with the market boosted by a large government supplemental budget. The budget for 2022 is expected to be a lot less and will be released in the third quarter of 2022. It is assumed it will be around half of the 2021 budget. There is also less customer demand due to the exceptionally strong sales in 2021. For this reason, a double-digit decline is forecast for 2022.

Rest of Asia -- Growth forecast for bigger markets

Most ultrasound markets in the rest of the Asia region declined in 2021, with Australia the only sizable market that grew. Many countries in Asia were still impacted by lockdowns due to the ongoing COVID-19 pandemic. Within the Southeast Asia market, the Philippines was one of the few countries that saw strong growth in 2021.

Most of the bigger markets are forecast for small growth in 2022, with the growth potential restricted due to the global supply chain disruptions and the economic impact of the COVID-19 pandemic. Malaysia is forecast for the largest growth in 2022, driven by the release of the government budget, which was delayed from the second half of 2021. Indonesia is also forecast for strong growth in 2022, driven by a large budget for value systems for use in primary care.

The Signify View

The global supply chain challenges have created new uncertainties in 2022, with many vendors affected by increased lead times and some forced to increase ultrasound prices. The vendors that perform the best in 2022 will be the ones that can best manage stock supply. Despite the short-term headwinds, the longer-term prospects for the ultrasound market remain favorable.

Related Market Report

"World Market for Ultrasound Equipment -- 2022 Edition" provides a data-centric analysis of current and projected demand for cart, compact, and handheld ultrasound systems. It features analysis of 30 geographic markets, with breakdowns by clinical application and product mix. The report is based on a robust primary research method and sales data reported by vendors of ultrasound equipment.

Mustafa Hassan is an analyst at Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Signify's major coverage areas are healthcare IT, medical imaging, and digital health.

The comments and observations expressed do not necessarily reflect the opinions of Auntminnie.com or AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.