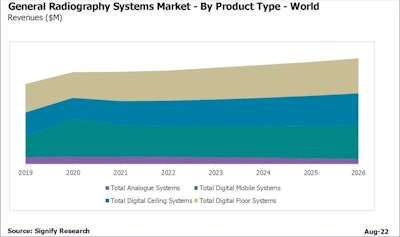

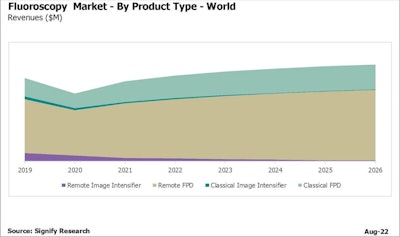

The fixed digital radiography (DR) rooms market experienced strong growth in 2021, with 15% growth to reach estimated revenues of $1.2 billion. Likewise, the fluoroscopy x-ray market returned to growth after a year of retraction in demand in 2020, with 18% year-on-year growth in 2021 and an estimated market size of $509 million.

These figures, taken from Signify Research's General Radiography and Fluoroscopy -- World 2022 report, show a strong recovery from the challenges experienced during the heights of the COVID-19 pandemic.

Demand returns to fixed-room radiography in 2021

Demand for fixed-room digital radiography systems returned to growth in 2021, as procurement budgets were made available after having been temporarily diverted to fund mobile x-ray purchases in the early phases of the pandemic. This allowed previously planned projects to resume, and upgrades and replacements to be installed.

For developed regions and countries, higher-end features to help tackle the backlog are now increasingly sought after, including autopositioning, cameras to ensure minimal patient movement before imaging, and artificial intelligence (AI)-based image analysis. Such features improve workflow, increase the throughput of an imaging department, and should help healthcare providers gradually clear some of the backlog created from the pandemic.

Conversely, the digital mobile x-ray market retracted by 18% in revenue terms in 2021, closing at $684 million. However, this decline was not as severe as previously forecast, with some sustained demand remaining. During the pandemic, obvious benefits of mobile imaging were reinforced, including portability for bedside imaging. Growth is expected to return for mobile DR in 2024, as replacement of older mobile systems drives demand.

For mobile radiography, the importance of brand loyalty in purchasing decisions also returned, after temporary focus solely on inventory available during the pandemic. This allowed smaller, local vendors to win significant share in new markets as they could service demand from local inventory more readily than global brands. Once global vendor inventory returned to a more normal level, purchasers often reverted to previous purchasing habits.

The general radiography market has experienced issues across the supply chain. Many components, including steel and semiconductors, are in short supply. Coupled with rising costs of transportation and limited availability of shipping, average selling prices are expected to rise by approximately 8% in the short term for general radiography systems, before stabilizing and declining again. This is also adding to lead times for projects, with systems taking a lot longer to reach customers.

Fluoroscopy also returned to growth, but demand is expected to become more specialized

Demand for fluoroscopy also returned to growth in 2021, with 18% year-on-year revenue growth to $509 million reported, up from $431 million in 2020. However, fewer fluoroscopic procedures are now being performed, with other modalities like CT and MRI taking precedence for procedures traditionally conducted on fluoroscopy systems. Upper gastrointestinal (GI) and barium swallow procedures remain the most procedures maintaining clinical demand for fluoroscopy and will remain essential for the long-term health of this modality.

With fewer fluoroscopic exams being performed and increased focus on return of investment in purchasing decisions, multipurpose systems are now even more desirable, especially in North America and Western Europe.

Fluoroscopy revenues will surpass 2019 pre-COVID levels next year, but growth will be limited after this, as other imaging modalities continue to challenge fluoroscopy. The fluoroscopy market is set to reach $614 million by 2026.

Key trends by region

North America

- The U.S. continues to be one of the few countries still favoring classical fluoroscopy systems, due to historical training practices, concerns of patient movement threatening image quality, and potential litigation. Demand is expected to gradually transition to remote systems, as new generations of radiographers are trained on remote systems; classical is however still expected to be dominant in the next five years.

- In the general radiography market, demand for high-end features is increasing, with tools to aid workflow becoming highly desirable for many imaging centers and hospitals.

Latin America

- The Latin America market continues to be highly cost sensitive, with options like computed radiography, retrofit, and analog systems remaining popular. For many end users, there is a desire to digitalize, but currently, the price point remains prohibitive. For the digital solutions that are sold, low-end systems with a lower price point are by far the preferred option -- over 50% of fixed and mobile solutions revenue came from the low-end in 2021.

- Fluoroscopy remains a very small market in Latin America, with the high price point proving a significant barrier for entry to this market. Brazil is the largest adopter of fluoroscopy in the region, with most other Latin American countries seeing minimal sales.

Western Europe

- High-end product continues to dominate the general radiography market in Western Europe, with 68% of revenue for fixed-room product coming from high-end systems in 2021. Floor-mounted systems sell more in unit terms in Western Europe, but with a lower average sales price; revenue from ceiling mounted solutions accounts for a higher proportion of the market.

- Most Western Europe markets have limited demand for fluoroscopy, with France being the key exception. Almost 30% of all revenue in Western Europe comes from this country. France is also unique in that many healthcare providers prefer to use dedicated fluoroscopy systems, rather than multi-purpose which is generally utilized in the rest of Western Europe.

Eastern Europe, Middle East, and Africa (EEMEA)

- Parts of EEMEA remain very cost-sensitive, with Africa and less-developed countries in the Middle East seeing high adoption rates of computed radiography, analog, and retrofit systems. For many, digital solutions are too costly, especially with the added infrastructure costs to enable PACS and other healthcare IT solutions on top of the imaging systems. Servicing imaging equipment can also be a barrier to adoption, with few engineers available locally to quickly fix broken systems.

- Fluoroscopy remains very small for most of EEMEA. The areas that have stronger installed bases are in French-speaking north Africa, where demand follows France. In parts of the Middle East, such as in Saudi Arabia, some trends follow the U.S., as some radiographers were trained in the States, and therefore follow classical fluoroscopy installation practices.

Asia Pacific

- Asia Pacific remains cost sensitive in many parts of the region, with 57% of fixed room revenue coming from the low-end segments. In countries like India, high levels of analog and computed radiography (CR) systems remain significant. In China, CT imaging is increasingly preferred over high-end digital radiography.

- Japan remains essential to the long-term growth of the fluoroscopy markets, with 45% of all unit sales in the region coming from this country alone. Elsewhere, demand is minimal with costs proving prohibitive to adoption.

Competitive landscape

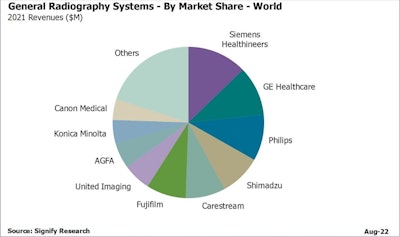

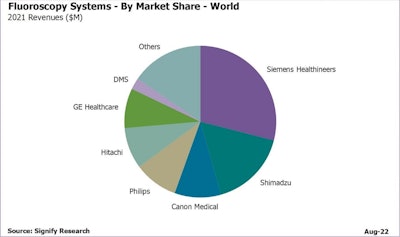

A return to a more conventional vendor landscape was evident in 2021, with global brands such as Siemens Healthineers, GE HealthCare and Philips regaining market share temporarily lost during the pandemic when demand outstripped the available supply. With these vendors able to fulfill demand, smaller local vendors dropped share.

In the fixed DR market, Siemens strengthened its position, with a gain of 2.5 percentage points. For mobile DR, GE reclaimed the top position, as Carestream Health experienced a difficult year after a very strong 2020.

For the fluoroscopy market, Siemens led with a very strong 2021, gaining further share. Shimadzu Medical Systems follows with strong sales in its domestic market.

Outlook

The fixed DR market will continue to recover. Budgets will continue to return for fixed-room installations, and projects previously postponed will be able to restart. Additionally, in some countries like the U.S., replacement cycles will stimulate further growth toward the end of the forecast. Globally, ceiling-suspended fixed-room product revenue will grow at a faster pace (5% compound annual growth from 2021-2026) than floor-mounted systems (4% compound annual growth rate), especially in more developed markets, where the desire for high-end features often found in ceiling-mounted solutions, are increasingly required.

Low-end system demand will continue to be driven by cost-sensitive markets such as Latin America, Africa, the Middle East, and parts of Asia. However, the price of digital solutions will need to be significantly reduced to be an attainable option for these regions. Until the price falls sufficiently, analog, CR, and retrofit systems will continue to play an important role.

Fluoroscopy systems will also see limited growth but will also come under increasing pressure from other modalities such as CT and endoscopy. At the end of the forecast, low-single-digit annual revenue growth is predicted. In many countries and regions, the demand for fluoroscopy will come predominantly from multipurpose systems; as fewer procedures are performed on the systems, budget holders will want to minimize downtime by enabling other general radiography imaging.

Bhvita Jani and Graham Cooke are senior marketing analysts at Signify Research. These statistics and analysis are taken from Signify Research's General Radiography and Fluoroscopy -- World 2022 report.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com.