Artificial intelligence (AI) and machine learning are becoming essential for biomedical research. From analyzing real-world data and scientific information to providing improved predictive outcomes, clinical trials are an important checkpoint in moving therapies from the lab to the clinic, and AI software can help researchers and clinicians reach their goals in several ways.

Diversity of AI solutions

For researchers, although often not directly involved in the clinical trial process, AI software is of critical importance to the biomedical research landscape and an area with great potential for optimization. For instance, only 12% of drug development programs ended in success in a 2000 to 2019 study, according to recent research. Inability to demonstrate efficacy or safety, flawed study design, participant dropouts, or unsuccessful recruitment all contributed to the low success rate and prevented research advancements from reaching the clinic. Therefore, vendors in this space are focusing on the use of AI-based software to provide solutions.

Ulrik Kristensen, PhD, is a senior market analyst at Signify Research.

Ulrik Kristensen, PhD, is a senior market analyst at Signify Research.- Information engines: Information engines often work across drug discovery and clinical trials, providing valuable information to both sides of the drug development process. Some vendors are using natural language processing to enable analysis and decision-making from structured and unstructured data with the goal of aggregating and mining disparate sources. IBM's Watson is using AI to improve clinical trial matching and enrollment, particularly for oncology trials. Aetion analyzes medical and pharmacy claims to understand which treatments work best for which patients and at which times. Concerto HealthAI extracts insights from oncology patients experiences with drugs to generate evidence for new therapeutic approaches.

- Patient stratification: The success of clinical trials often relies on having the right group of individuals and the ability of researchers to track their appropriate responses. nQ Medical and WinterLight Labs are using speech biomarkers and patient interactions with electronic devices and touchscreens to quantitatively detect and track progression of neurological disorders for more automated classification. Alternatively, vendors like WuXi NextCODE and Tempus Labs use DNA sequencing and genetic biomarkers to subtype patients and associate them with treatment responses.

- Operations: Companies like Trials.ai, Antidote.me, and Deep 6 AI develop AI applications that accelerate the recruitment process by making it easier for patients to enroll and engage or by analyzing medical records and relevant information to identify more patients suitable for a specific trial. A San Francisco-based startup called Unlearn.ai is trying to reduce the number of subjects required for clinical trials by using digital twins as synthetic control arms for a proportion of the placebo controls.

A new ecosystem in clinical trials

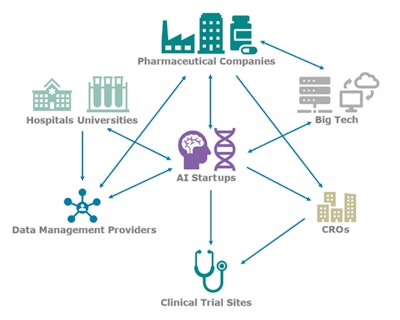

AI is changing the paradigm of biomedical research, particularly in the clinical trial space, by increasing success rates and decreasing costs. AI technology vendors are most commonly working directly with the pharmaceutical company to sponsor trials, optimizing trials using their own deidentified data collated directly from hospitals and academic centers, and in many cases additional enterprise clinical trial data from the sponsor. The AI vendor then collaborates with the assigned contract research organization (CRO) in executing the trial. These organizations provide the expertise and network necessary to run a typical clinical trial, but they are in some cases seen as both a partner and a competitor for these new AI-software entrants, particularly for larger firms already able to run trials through their own network of clinical partner sites.

Image courtesy of Signify Research.

Image courtesy of Signify Research.Data management vendors such as InterSystems, LifeImage, Medexprim, and Segmed offer faster and easier ways to obtain training data sets and connect with pharmaceutical companies' enterprise data. Even large technology firms are integrated. AWS and Google provide their cloud hosting services to many AI startups, but Microsoft and Google are also working directly with pharmaceutical companies to build AI capabilities around the massive amounts of enterprise and clinical trial data often stored at these companies.

As the diversity in technologies and the complexity of the ecosystem increase, will the supply chain need to be consolidated and simplified? Will each individual technology provider continue to work directly with the sponsor, or will CROs increasingly organize the workflow and orchestrate the stakeholders?

As total investment in AI for drug development and clinical trials has now passed $5.2 billion and many partnerships have already been established between AI startups and pharmaceutical companies, CROs will soon be looking to leverage AI-based technology to ensure they remain central players in the clinical trials process; in the near term through a combination of partnerships and startup support, and in the longer term through more integrated solutions.

Ulrik Kristensen, PhD, is a senior market analyst at Signify Research with eight years of experience with the healthtech industry. He is part of the Healthcare IT team and leads the research covering drug development, oncology, and genomics. Ulrik holds a Master of Science in Molecular Biology from Aarhus University and a doctorate from University of Strasbourg. He can be reached at [email protected].

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Its major coverage areas are healthcare IT, medical imaging, and digital health. Clients include technology vendors, healthcare providers and payors, management consultants, and investors. Signify Research is headquartered in Cranfield, UK.

The comments and observations expressed do not necessarily reflect the opinions of Auntminnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.