Procedure volume at U.S. angiography labs slowed to a 1% annual growth rate in 2010, compared with rates greater than 4% in previous years. Future market growth in the angiography segment may rely on sales of replacement systems, according to a new report by market research firm IMV Medical Information Division.

IMV's 2011 study of the angiography market estimates that 4.9 million procedures were performed in 2010 at 1,710 interventional angiography sites in the U.S. Total procedures performed in angio labs grew slightly more than 2% from 2008 to 2010.

The report summarized the results of a telephone survey conducted from February through July 2011 with 455 radiology administrators and chief technologists in the U.S. The survey responses were projected to the identified universe of 1,710 hospitals of 150-plus beds that perform angiography procedures.

In IMV's survey, an interventional angiography site is defined as a hospital that provides angiography services where at least 50% of its volume is for noncoronary interventional angiography procedures.

Market view

"Slower growth within the angio labs may be attributable to some of the procedures in general moving out of the radiology purview and moving into other labs, such as hybrid operating rooms, dedicated vascular labs, or cath labs," said Lorna Young, senior director of market research at IMV. "While interventional radiologists have often been the innovators for interventional procedures, these procedures have, over time, often been adopted by other specialists, who may initially share time in the angio lab to perform the procedure, but may over time perform them in other labs."

In 2010, 36% of the total procedures performed in angiography labs were noncoronary vascular angiography procedures, both diagnostic and therapeutic. Procedure breakdown is as follows:

- Peripherally inserted central catheter (PICC) lines/vascular access: 31%

- Vertebroplasty, sacroplasty, or kyphoplasty: 4%

- Biopsy: 8%

- Coronary angiography: 2%

- Radiofrequency (RF) tumor ablation studies (with angio guidance): 1%

- Other RF procedures: 7%

- Other procedures: 11%

Compared with IMV's 2008/2009 study, the number of noncoronary vascular angiography procedures performed in angio labs in 2010 declined approximately 16%, from 2.1 million to 1.75 million procedures.

Young also observed that the angio lab installed base in the U.S. has decreased slightly.

"We estimate that the number of angio units went down slightly, from 3,180 units in 2008 to about 3,000 units in 2010," she said. "This may be due to the retirement of older systems, which are not necessarily replaced. As procedures have basically been flat, the number of procedures performed per unit has increased 9% from 2008 to 2010, resulting in increased productivity per installed unit."

Replacement

Facilities tend to retain angio units for extended periods of time. The average age of the installed base is 7.1 years, while the average replacement age for an angiography unit is 11.5 years, which is consistent with IMV's 2008/2009 study.

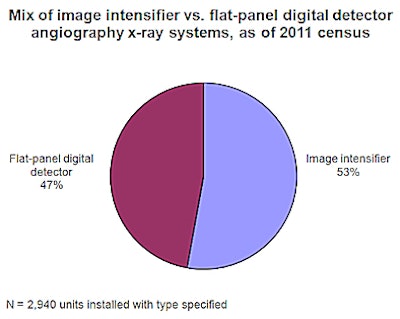

"Going forward, it's primarily a replacement market ... so the angio market has relatively limited growth potential," Young said. "A key motivator for replacements is going to be to get flat-panel detectors. Flat-panel units comprise about 50% of the installed base, so half of the units don't have this capability yet. In the past three years, flat panels have fairly consistently been the configuration of choice across the board."

|

| Source: IMV 2011 Interventional Angiography Lab Market Summary Report. |

In addition, sales of angio labs in the future will primarily consist of new units; 98% of the planned units will be new, and 2% will be refurbished.

"Hospitals aren't growing their angio lab capacity, as purchases for additional units have gone down from about a third of the planned purchases over the past decade to about a quarter," said Young.

The survey shows that 60% of angiography sites have no dollars budgeted for angiography lab capital equipment for 2012. The proportion of sites with large capital budgets for angiography equipment appears to be increasing slightly from 2011 to 2012, with 19% of the sites indicating budgets of $1 million or more for 2012, compared with 15% for 2011 budgets.

However, compared with 2005 budgets as estimated by IMV's 2004/2005 census, the proportion of sites with $1 million or more budgeted has decreased from 27% to 19%.

Angio lab use

Nearly three-fifths of the angiography sites have nonradiologists using the angio suite. The larger hospitals with 400 or more beds have a smaller proportion of nonradiologists using the angio suite: 52%, compared with 59% at midsized hospitals and 77% at smaller hospitals, according to the IMV report.

The most common nonradiology specialties using the angio lab are vascular/vascular surgery and cardiology, followed by neurosurgery, surgery, neurology, gastroenterology, cardiothoracic surgery, and pulmonary.

In addition to increased per-unit productivity, productivity of radiologic technologists is increasing. "The average number of technologists per site who run the equipment has decreased slightly from 4.1 in 2008 to 3.6 in 2010, while procedures have been flat, so the procedures performed per tech has increased," Young said. "A tech typically averages 795 procedures per year."

As the installed base and the average number of technologists have decreased, patient wait times have increased.

"Sites aren't adding units to the installed base, so the waiting times have increased since a decade ago, but still over about 80% of the patients are getting in within two days for a nonemergency procedure," said Young.

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.